Shares exploded higher today in Wet Seal (WTSLA) after coming out with a strong earnings report and a solid call. Despite their mixed guidance (guided higher on earnings, and slightly light on revenues), shares are up 13.5% to 4.85 after hitting an intraday high of 5.12 earlier on very heavy trading (over 7MM shares, and it's not even 10am here).

Some analyst activity today following yesterday's announcement... JP Morgan upgraded the company from Neutral to Overweight, Brean Murray reiterated their buy rating and also upped their price target to $6 while continuing to aggressively recommend the stock, and Roth Capital also reiterated their buy rating.

I was so busy yesterday that I didn't have the chance to write up my thoughts on the earnings call, and now it's time for me to get to work. Have an awesome day everyone!

Go Seal Go!

--- Edit #1 ---

The Seal couldn't hold on to most of its gains... closed end of day up 4.7% at 4.48. I'm not complaining, but sure would have been sweet to sell off a chunk at $5 and buy back in for a 10% discount. Hindsight's 20/20, so I can't kick myself. Still looking for a nice longer-term move in the stock. Nearly 9.5MM shares traded today. That's just HUGE for this stock... roughly 10% of the shares outstanding.

I should also note that Roth Capital reiteration also came with a price target increase to $6 a share.

Anyway, nice to end the week on such a nice note. Have a good one, everybody.

Main Page: bruteforcex.blogspot.com

Random posts about anything I've found interesting.

Contact Me: BruteForceXYZ (at) hotmail (dot) com

Friday, May 30, 2008

Wednesday, May 28, 2008

Upcoming Wet Seal Earnings

Wet Seal (WTSLA) is going to release its earnings numbers tomorrow afternoon. Not sure why this time around the call is happening after the bell, because they have typically done it before the market open. In any case, I'm not too worried about the quarter's numbers given that the company pre-announced just a few weeks ago better than expected earnings (estimating 0.07-0.08 EPS on roughly $142MM in revenue).

I am very interested to hear what the management team has to say about their Arden B division. The new look for Arden B is highly anticipated, and the full rollout should be happening soon... next week, I believe. It's nice to know that the flagship Wet Seal stores are doing just fine, if not great. Only recently has the company broken down their numbers for its two divisions separately. Today's stock price move was very much welcome by me, but as always, anything can happen during an earnings call.

Much of today's stock move was probably driven by analyst comments. Brean Murray came out saying that it believed that the company was making material progress with its business model. Based on their research note, they continue to believe that material upside opportunities remain the Wet Seal management further improves the business model and drives solid returns. And, while they expect to see some costs incurred due to the clearing out of unpopular merchandise at Arden B, they are expecting a strong showing by the Wet Seal division. They sum it up saying that they believe that the cash balances will remain healthy, and they continue to find attractive the risk/reward of WTSLA shares.

I also heard that Merriman Curhan Ford came out with a reiteration of their Buy rating, but I am unsure of the reliability of the source.

Anyway, that's all for now. But, I will leave you with this outfit that can be yours for only $79.99.

I am very interested to hear what the management team has to say about their Arden B division. The new look for Arden B is highly anticipated, and the full rollout should be happening soon... next week, I believe. It's nice to know that the flagship Wet Seal stores are doing just fine, if not great. Only recently has the company broken down their numbers for its two divisions separately. Today's stock price move was very much welcome by me, but as always, anything can happen during an earnings call.

Much of today's stock move was probably driven by analyst comments. Brean Murray came out saying that it believed that the company was making material progress with its business model. Based on their research note, they continue to believe that material upside opportunities remain the Wet Seal management further improves the business model and drives solid returns. And, while they expect to see some costs incurred due to the clearing out of unpopular merchandise at Arden B, they are expecting a strong showing by the Wet Seal division. They sum it up saying that they believe that the cash balances will remain healthy, and they continue to find attractive the risk/reward of WTSLA shares.

I also heard that Merriman Curhan Ford came out with a reiteration of their Buy rating, but I am unsure of the reliability of the source.

Anyway, that's all for now. But, I will leave you with this outfit that can be yours for only $79.99.

Recap of Recent Weeks

I said in a previous post that I was down in LA not long ago... anyway, while down there we got to hang out with my buddy, Jorge, and his wife in Dana Point. We started off with some drinks at their place, then headed over to this wine and cheese bar called Purple Feet. Though I'm not too big on wine and don't know much about it or cheeses, it was hard to really appreciate the finer details of the evening. But, I must say that I was able to pick out which wines and which cheeses I enjoyed the most. And, I guess that's what really counts.

After our wine experience, we hit up a normal bar and had some more drinks and some feed before heading back to their place. We all had a nice night out, and it was really good to see them again. We talk all the time, but we rarely find the time to meet up. The next time I'm down in SoCal, I'm going to have to call up the GZA, since I'm way overdue to see him... and, I still haven't seen his baby daughter.

Okay, so this past weekend, my sister and Duke showed up along with my special guest, and we mostly didn't do anything but lounge around. We did get to play a lot of Rockband, and I still suck at it royally. I did pick up a new style of playing the guitar, because the normal style started causing my arms and fingers to cramp up. So, now I play the instrument as if it were a steel guitar. And, to think that I thought I had invented the new style of playing... I had dubbed it my 'piano' style. Ha ha.

In continuing my Best Picture Quest, I watched An American In Paris (1951 winner) tonight. It's a movie built around Gershwin's piece with the same name. I was entertained, and I felt the movie was lively. I suppose that it's considered a musical, but there wasn't a whole lot of singing in it. I mean there was definitely singing in it, but if dance-ical were a word, then that'd be a much better category.

There was a whole lot of dancing, and Gene Kelly, who played the lead role, is one hell of a dancer. That guy's got some serious skills, and he's very charismatic. I would think that he would definitely be the Brad Pitt of his generation. Anyway, if you enjoy musicals, I think you'd probably find the movie enjoyable. The plot is really quite simple, so it's a good one to watch if you're a bit tired and want to occupy yourself for a couple of hours.

I guess that's it for now, but before I end this... several people have been warning me about Lehman Brothers (LEH), and a couple have recommended it as a potential short (especially, if it rallies from here). Not sure if I will act on their recommendations or not, but it is now on my list of potential trades. Just figured I'd throw that out there for anyone who wants to do their own research on the situation.

After our wine experience, we hit up a normal bar and had some more drinks and some feed before heading back to their place. We all had a nice night out, and it was really good to see them again. We talk all the time, but we rarely find the time to meet up. The next time I'm down in SoCal, I'm going to have to call up the GZA, since I'm way overdue to see him... and, I still haven't seen his baby daughter.

Okay, so this past weekend, my sister and Duke showed up along with my special guest, and we mostly didn't do anything but lounge around. We did get to play a lot of Rockband, and I still suck at it royally. I did pick up a new style of playing the guitar, because the normal style started causing my arms and fingers to cramp up. So, now I play the instrument as if it were a steel guitar. And, to think that I thought I had invented the new style of playing... I had dubbed it my 'piano' style. Ha ha.

In continuing my Best Picture Quest, I watched An American In Paris (1951 winner) tonight. It's a movie built around Gershwin's piece with the same name. I was entertained, and I felt the movie was lively. I suppose that it's considered a musical, but there wasn't a whole lot of singing in it. I mean there was definitely singing in it, but if dance-ical were a word, then that'd be a much better category.

There was a whole lot of dancing, and Gene Kelly, who played the lead role, is one hell of a dancer. That guy's got some serious skills, and he's very charismatic. I would think that he would definitely be the Brad Pitt of his generation. Anyway, if you enjoy musicals, I think you'd probably find the movie enjoyable. The plot is really quite simple, so it's a good one to watch if you're a bit tired and want to occupy yourself for a couple of hours.

I guess that's it for now, but before I end this... several people have been warning me about Lehman Brothers (LEH), and a couple have recommended it as a potential short (especially, if it rallies from here). Not sure if I will act on their recommendations or not, but it is now on my list of potential trades. Just figured I'd throw that out there for anyone who wants to do their own research on the situation.

Friday, May 23, 2008

Rock Band and License Plate Game

You all read before about how much I suck at Guitar Hero. So, it comes as no surprise that I also suck at Rock Band. I think I am best at the singing and worst at the drums. And, for anyone that has ever seen me do karaoke, you have a pretty good idea of how bad I am at this game. I guess I simply have no rhythm. I should stick to word games.

Now, speaking of word games, here's a game I invented long ago to help pass the time on long drives. It's really quite simple, and I think it's pretty fun. You can also come up with various ways to score.

First, the game only works with license plates with 3 letters in a row. For you California folks, this is easy to find... since all the auto plates have the format #LLL###. Okay, so here's what you want to do. You want to find a word that contains those 3 letters in that order (but, they need not be consecutive). As you would expect, some patterns are really easy, others are really tough, and some are just impossible.

If we have a plate that read 1AFG123, then we're looking for AFG in that order, but not necessarily consecutive. One legitimate answer would be crAFtinG. Now, you can just play this for speed against friends, where the first person that produces a legitimate word wins the point. Or, you can play the more advanced and more challenging version where the goal is to get the shortest valid word. Everyone gets a chance to improve upon the current word and it's not turn-based... it's a free for all. If you can improve upon the best, then you just blurt it out to stake your claim.

Like, say we have a few players in the game. I could start with say deAFeninG (9 letters). I could then blurt out an improvement... crAFting (8 letters). Another player can then shout out rAFtinG (7 letters), and someone else could come back with AFGhan (6 letters). If no one else can't find one shorter, then whoever said it wins that point.

Of course, you should alter the rules where you see fit. One good rule is that if the 3 letters form a word already, then it's pointless and shouldn't be used. There are lots of ways to tweak the game to make it more enjoyable.

Anyway, if you like words, give this game a try some time.

Now, speaking of word games, here's a game I invented long ago to help pass the time on long drives. It's really quite simple, and I think it's pretty fun. You can also come up with various ways to score.

First, the game only works with license plates with 3 letters in a row. For you California folks, this is easy to find... since all the auto plates have the format #LLL###. Okay, so here's what you want to do. You want to find a word that contains those 3 letters in that order (but, they need not be consecutive). As you would expect, some patterns are really easy, others are really tough, and some are just impossible.

If we have a plate that read 1AFG123, then we're looking for AFG in that order, but not necessarily consecutive. One legitimate answer would be crAFtinG. Now, you can just play this for speed against friends, where the first person that produces a legitimate word wins the point. Or, you can play the more advanced and more challenging version where the goal is to get the shortest valid word. Everyone gets a chance to improve upon the current word and it's not turn-based... it's a free for all. If you can improve upon the best, then you just blurt it out to stake your claim.

Like, say we have a few players in the game. I could start with say deAFeninG (9 letters). I could then blurt out an improvement... crAFting (8 letters). Another player can then shout out rAFtinG (7 letters), and someone else could come back with AFGhan (6 letters). If no one else can't find one shorter, then whoever said it wins that point.

Of course, you should alter the rules where you see fit. One good rule is that if the 3 letters form a word already, then it's pointless and shouldn't be used. There are lots of ways to tweak the game to make it more enjoyable.

Anyway, if you like words, give this game a try some time.

Monday, May 19, 2008

West Is Best Screw The Rest aka WIBSTR

I was down in LA over the weekend... more on that in a future post.

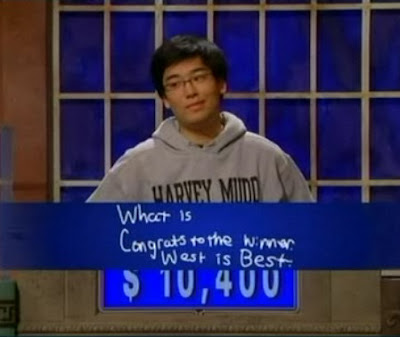

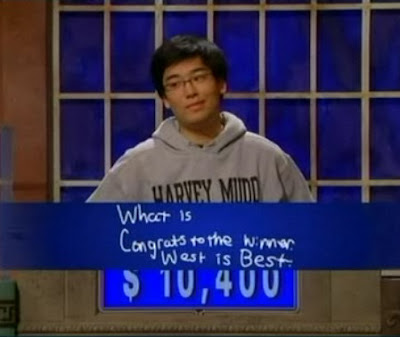

Anyway, while I was down there, Day 2 of the College Jeopardy Finals was aired. A young kid from Harvey Mudd College named Andrew Chung had made it to the finals. (Congratulations!)

By the time they got to the very last question, I guess he had drawn a blank and was resigned to the fact that he would be coming in third place, so instead of giving a real answer (err, question), he submitted a shout-out to HMC's West Dorm. For the curious, here's a link to HMC dorm descriptions.

All I can say is... that's just awesome.

Even more awesome than this Mudder's 15 seconds of fame.

Anyway, while I was down there, Day 2 of the College Jeopardy Finals was aired. A young kid from Harvey Mudd College named Andrew Chung had made it to the finals. (Congratulations!)

By the time they got to the very last question, I guess he had drawn a blank and was resigned to the fact that he would be coming in third place, so instead of giving a real answer (err, question), he submitted a shout-out to HMC's West Dorm. For the curious, here's a link to HMC dorm descriptions.

All I can say is... that's just awesome.

Even more awesome than this Mudder's 15 seconds of fame.

Friday, May 16, 2008

GE Buy-Write Trade

I followed CoryBear into this one. I opted for a slightly different trade, only because GE fell to $32 today.

My Buy-Write trade on General Electric (GE) just executed. I put in a limit at 31.45, and it just hit.

Bought GE at $32.01.

Sold GE June 32.50 Calls (GEFZ) at $0.56.

First, let me say that I think it's worth buying GE below $32. That said, let's get to some of the details. So, ignoring commissions, each 100 shares costs us $3145. The hope is to get called away at 32.50 next month. I do not believe the ex-div will be prior to the June expiration, unfortunately.

If called away, we sell 100 shares for $3250. That represents $105 gain on $3145, which is a tidy 3.34% for 5 weeks. This is roughly 40.7% annualized return.

If not called away, then I basically bought more GE at a cost basis of $31.45, which I feel is a fine price. If we aren't called away, and the price of GE hasn't dropped significantly, then we can go ahead and sell the July calls at a similar strike and price to further reduce our cost basis, and ultimately provide a nice return when shares are finally called away.

The worst thing that can happen is a GE crash, but if it did, I am more than willing to hold on to the GE shares, as I feel the price I'm getting them for ($31.45) is more than satisfactory.

That's all for now. Enjoy the weekend!

My Buy-Write trade on General Electric (GE) just executed. I put in a limit at 31.45, and it just hit.

Bought GE at $32.01.

Sold GE June 32.50 Calls (GEFZ) at $0.56.

First, let me say that I think it's worth buying GE below $32. That said, let's get to some of the details. So, ignoring commissions, each 100 shares costs us $3145. The hope is to get called away at 32.50 next month. I do not believe the ex-div will be prior to the June expiration, unfortunately.

If called away, we sell 100 shares for $3250. That represents $105 gain on $3145, which is a tidy 3.34% for 5 weeks. This is roughly 40.7% annualized return.

If not called away, then I basically bought more GE at a cost basis of $31.45, which I feel is a fine price. If we aren't called away, and the price of GE hasn't dropped significantly, then we can go ahead and sell the July calls at a similar strike and price to further reduce our cost basis, and ultimately provide a nice return when shares are finally called away.

The worst thing that can happen is a GE crash, but if it did, I am more than willing to hold on to the GE shares, as I feel the price I'm getting them for ($31.45) is more than satisfactory.

That's all for now. Enjoy the weekend!

Thursday, May 15, 2008

Quick Update

Sold Manitowoc (MTW) May 40 Puts (MTWQH) at 0.35. Equal number of shares to cover my current position. If put to me, then I will have doubled my position, but if that happens, I will be looking to sell the new shares. I'm already full in MTW. Otherwise, it doesn't hurt too much to pocket 0.8% in a day (actually quite a bit more than that due to actual margin requirements being a lot lower).

Today's a good day... two main movers for the portfolio are:

Wet Seal (WTSLA) now up to 4.13. Go Seal Go!

EMC up a nice 6.3% today to 17.75.

I thought a bit more about Citigroup (C), and I think that at the very least I'll at least hold a piece of my current shares for longer. But, if any opportunity arises for me to exit partially, I would probably take it. Anyway, I guess this means I'll add C to my official list.

Today's a good day... two main movers for the portfolio are:

Wet Seal (WTSLA) now up to 4.13. Go Seal Go!

EMC up a nice 6.3% today to 17.75.

I thought a bit more about Citigroup (C), and I think that at the very least I'll at least hold a piece of my current shares for longer. But, if any opportunity arises for me to exit partially, I would probably take it. Anyway, I guess this means I'll add C to my official list.

Tuesday, May 13, 2008

Quick Update

Sold the Apple (AAPL) bull call spread for $9.95, just a nickel less than the max value. The May 160's (APVEL) sold for 29.90 and the May 170's (APVEN) were bought at 19.95. Excluding transaction costs, this was good for a 140% gain. Guess it's time to finally buy that damn LCD HD I've been talking about for who knows how long.

And, of course, I can't neglect mentioning my current obsession... The Wet Seal (WTSLA) is up nicely today, but it is running into what looks like a barrier at $4 barrier today. Let's see if it can get past that magic number so I can sell off a piece.

--- Edit #1 ---

Something might also be going on with Mattel (MAT). The stock is up solidly in a down market on no apparent news, and Briefing is reporting that its May 20 calls are seeing interest with 1350 contracts trading compared to an open interest of 2060.

--- Edit #2 ---

The mf'ing Seal did manage to break past the $4 mark, and so I sold 20% of my WTSLA at 4.07. Holding the remaining 80% with no current plans on further selling. The remaining shares still represents a really large position for me, so don't think that I've lost any confidence in this beast.

--- Edit #3 ---

Got some of the details from the Brean Murray report, which was likely the reason for today's 6% move in shares of Wet Seal (WTSLA).

Brean Murray mentions a scheduled full-rollout of the new Arden B, which offers a more balanced selection of clothing as compared to its previous 'all or nothing' approach. They say that the Wet Seal management remains highly encouraged by the new looks, and believes the chain will eventually return to profitability. Brean Murray also believes that Arden B will either show real progress or be closed down. They believe (as do I) that either of these alternatives would be seen as a positive.

Wet Seal earnings are scheduled in a couple more weeks on May 29. We should hear a lot more about what's going on then. For now, let's enjoy our gains.

And, of course, I can't neglect mentioning my current obsession... The Wet Seal (WTSLA) is up nicely today, but it is running into what looks like a barrier at $4 barrier today. Let's see if it can get past that magic number so I can sell off a piece.

--- Edit #1 ---

Something might also be going on with Mattel (MAT). The stock is up solidly in a down market on no apparent news, and Briefing is reporting that its May 20 calls are seeing interest with 1350 contracts trading compared to an open interest of 2060.

--- Edit #2 ---

The mf'ing Seal did manage to break past the $4 mark, and so I sold 20% of my WTSLA at 4.07. Holding the remaining 80% with no current plans on further selling. The remaining shares still represents a really large position for me, so don't think that I've lost any confidence in this beast.

--- Edit #3 ---

Got some of the details from the Brean Murray report, which was likely the reason for today's 6% move in shares of Wet Seal (WTSLA).

Brean Murray mentions a scheduled full-rollout of the new Arden B, which offers a more balanced selection of clothing as compared to its previous 'all or nothing' approach. They say that the Wet Seal management remains highly encouraged by the new looks, and believes the chain will eventually return to profitability. Brean Murray also believes that Arden B will either show real progress or be closed down. They believe (as do I) that either of these alternatives would be seen as a positive.

Wet Seal earnings are scheduled in a couple more weeks on May 29. We should hear a lot more about what's going on then. For now, let's enjoy our gains.

Sunday, May 11, 2008

Santa Clara Traffic Cams

I had no idea that there were so many traffic cameras in Santa Clara County providing live streaming video.

Check this out... you can access each camera individually and pull up a live stream. Santa Clara Traffic Cams.

Here's a direct link to one of the live streams. This is a camera that is showing the Montague Expressway and Great Mall Pkwy/Capitol Ave intersection in Milpitas. Anyone from around these parts knows this spot. But, did anyone know that you're on camera when you're there?

---- Edit #1 ----

More traffic camera fun... here's a live stream (updated every 2 seconds) of the Las Vegas Blvd / Flamingo intersection in Vegas. (Bah... you have to click the image, which takes you to the main web site to view it. Still pretty cool though.)

Check this out... you can access each camera individually and pull up a live stream. Santa Clara Traffic Cams.

Here's a direct link to one of the live streams. This is a camera that is showing the Montague Expressway and Great Mall Pkwy/Capitol Ave intersection in Milpitas. Anyone from around these parts knows this spot. But, did anyone know that you're on camera when you're there?

---- Edit #1 ----

More traffic camera fun... here's a live stream (updated every 2 seconds) of the Las Vegas Blvd / Flamingo intersection in Vegas. (Bah... you have to click the image, which takes you to the main web site to view it. Still pretty cool though.)

Saturday, May 10, 2008

Poker Bots

I don't play very much online poker these days. Games are generally many times tougher than they used to be, and I guess I just don't have quite as much time as I used to have. Anyway, a friend of mine sent this my way, and I thought that it might be an interesting read for those who do (or did) play online.

How I Built a Working Poker Bot

How I Built a Working Poker Bot

Friday, May 09, 2008

Quick Update

Grabbed a piece of Citigroup (C) at 23.69 today. While I might want to hold this longer-term, there's still a fair bit of uncertainty so I'll keep it off of my long-term portfolio list for the time being. I could easily be wrong about this company and be viewing the current situation incorrectly, but I believe that the measures that the company is taking to reduce its exposure to potentially value-destroying assets, businesses, accounts, etc. are a good thing. Maybe I am putting too much trust into Vikram and his words.

On a related note, I've been accumulating (perhaps too early) shares of the Financial Sector SPDR (XLF) in the retirement account this year, and I'd say that I'm about halfway done with that. Even if I'm early, I think that with a long enough time horizon, today's prices can't be so bad as to produce a horrible return. I guess we'll have to wait and see.

On a related note, I've been accumulating (perhaps too early) shares of the Financial Sector SPDR (XLF) in the retirement account this year, and I'd say that I'm about halfway done with that. Even if I'm early, I think that with a long enough time horizon, today's prices can't be so bad as to produce a horrible return. I guess we'll have to wait and see.

Thursday, May 08, 2008

Boom Goes The Seal and More

Today, all of the retailers reported their same store sales figures. For the most part, retailers came in with numbers that were ahead of expectations.

My number one position, Wet Seal (WTSLA), did not disappoint. The company's Wet Seal division came in with SSS at +3.1%, and its flailing Arden B SSS came in at -17%, which resulted in a -1.9% overall comp. This was well ahead of the expected -5.8% SSS comp. The company's total net sales for the month rose 7% (Wet Seal division sales +15% and Arden B sales -18%).

The news gets better... the company increased its fiscal Q1 EPS estimate to 0.07-0.08 from 0.04-0.06 due to efficiency improvement/cost cutting. This is a solid boost... a whopping increase of 17 to 100% (using the midpoints, we get a 36% increase). And, it seems that their CEO continues to clean house, as the company reported the resignation of their Chief Merchandising Officer from the Wet Seal Division.

Anyone who saw the trading today knows that today was a very good day for me. The stock closed up 0.25 (+6.9%) at 3.85 on heavy volume (3.4MM shares vs. 1.4MM shares average). It is now within striking distance of my first sell point. When it does get there, I do not believe I will be selling more than 25% of the overall position.

In other news, Manitowoc (MTW) has jumped back into the 40's again. Recall that they recently announced their intention to acquire Enodis (London: ENO). Anyway, Illinois Tool Works (ITW) announced today that they bid more for Enodis, and that their bid was going to be accepted. I guess we'll see how this plays out. Seems like the market is glad to have ITW relieve MTW of its ENO obligation.

That's it for now. Let's hope that tomorrow brings us more of this good stuff... gotta love it!

My number one position, Wet Seal (WTSLA), did not disappoint. The company's Wet Seal division came in with SSS at +3.1%, and its flailing Arden B SSS came in at -17%, which resulted in a -1.9% overall comp. This was well ahead of the expected -5.8% SSS comp. The company's total net sales for the month rose 7% (Wet Seal division sales +15% and Arden B sales -18%).

The news gets better... the company increased its fiscal Q1 EPS estimate to 0.07-0.08 from 0.04-0.06 due to efficiency improvement/cost cutting. This is a solid boost... a whopping increase of 17 to 100% (using the midpoints, we get a 36% increase). And, it seems that their CEO continues to clean house, as the company reported the resignation of their Chief Merchandising Officer from the Wet Seal Division.

Anyone who saw the trading today knows that today was a very good day for me. The stock closed up 0.25 (+6.9%) at 3.85 on heavy volume (3.4MM shares vs. 1.4MM shares average). It is now within striking distance of my first sell point. When it does get there, I do not believe I will be selling more than 25% of the overall position.

In other news, Manitowoc (MTW) has jumped back into the 40's again. Recall that they recently announced their intention to acquire Enodis (London: ENO). Anyway, Illinois Tool Works (ITW) announced today that they bid more for Enodis, and that their bid was going to be accepted. I guess we'll see how this plays out. Seems like the market is glad to have ITW relieve MTW of its ENO obligation.

That's it for now. Let's hope that tomorrow brings us more of this good stuff... gotta love it!

Tuesday, May 06, 2008

Weekend in Tahoe

Over the weekend, I found myself in North Lake Tahoe (Incline Village) with a sharpshooter, her co-workers, and their significant others. Everything about the trip was taken care of by her company as a team reward for meeting project milestones. Sweet!

When I've gone out to that area in the past, I've pretty much been in South Lake Tahoe, where all the casinos are located. I don't typically do much skiing or snow sports, so I also rarely find myself out there during this time of the year. For those of you not in the know, there's still snow out there. It was still pretty cold with overnight lows in the high 20's.

Anyway, the sharpshooter (we'll get to why she's a sharpshooter in a minute) and I stayed at a condo with one of her co-workers and his girlfriend. A bunch of others stayed over at a semi-baller fully loaded (multiple plasma TV's, full-sized pool table, etc) five bedroom vacation house nearby. We hung out at the house a fair bit, and just drank beers and played a couple of interesting card games.

One was called Wizard, and another one was called Mü. Wizard was fun and simple. I won when we played. Mü was really complex, but it was really a fascinating game. There were 5 natural 'suits' but a 6th suit would be generated from the High and Low trumps, which would vary based on an auction process. It's a bit too complicated to explain here, but if you like strategy card games and know a few others who do as well, I think would likely enjoy the game tremendously. I tied for first in that game, which was pretty coincidental. I would imagine that it's pretty rare to end up in a tie.

Besides being lazy and staying in, we also made a quick trip out to Reno to do a tiny bit of gambling and playing carnival games at the Circus Circus Midway. One of the games at Circus Circus was a Bottle Cork Pistol game. You load up an air gun with a small cork and you'd shoot the cork at empty soda cans. You get 3 shots for a buck. She nailed 2 cans with her 3 shots and won a nice stuffed bear. I played twice, but I only managed to score 0 and 1 (good for a tiny prize). After playing that and other games for a while, we had won a small collection of stuffed animals, including two frogs.

Then, I lost $100 playing blackjack for maybe half an hour. Nothing eventful really. Up $60 at the peak, down $100 at the nadir.

And, what good is a trip without good food? On Sunday night, 11 of us went to do some fine dining at the Lone Eagle Grille. The food was fantastic, and the service was great. I finally got to try some elk, which I've been wanting to try for some time now.

Here are the food pictures...

That's it... and, now here I am still at work (but, taking a short break).

When I've gone out to that area in the past, I've pretty much been in South Lake Tahoe, where all the casinos are located. I don't typically do much skiing or snow sports, so I also rarely find myself out there during this time of the year. For those of you not in the know, there's still snow out there. It was still pretty cold with overnight lows in the high 20's.

Anyway, the sharpshooter (we'll get to why she's a sharpshooter in a minute) and I stayed at a condo with one of her co-workers and his girlfriend. A bunch of others stayed over at a semi-baller fully loaded (multiple plasma TV's, full-sized pool table, etc) five bedroom vacation house nearby. We hung out at the house a fair bit, and just drank beers and played a couple of interesting card games.

One was called Wizard, and another one was called Mü. Wizard was fun and simple. I won when we played. Mü was really complex, but it was really a fascinating game. There were 5 natural 'suits' but a 6th suit would be generated from the High and Low trumps, which would vary based on an auction process. It's a bit too complicated to explain here, but if you like strategy card games and know a few others who do as well, I think would likely enjoy the game tremendously. I tied for first in that game, which was pretty coincidental. I would imagine that it's pretty rare to end up in a tie.

Besides being lazy and staying in, we also made a quick trip out to Reno to do a tiny bit of gambling and playing carnival games at the Circus Circus Midway. One of the games at Circus Circus was a Bottle Cork Pistol game. You load up an air gun with a small cork and you'd shoot the cork at empty soda cans. You get 3 shots for a buck. She nailed 2 cans with her 3 shots and won a nice stuffed bear. I played twice, but I only managed to score 0 and 1 (good for a tiny prize). After playing that and other games for a while, we had won a small collection of stuffed animals, including two frogs.

Then, I lost $100 playing blackjack for maybe half an hour. Nothing eventful really. Up $60 at the peak, down $100 at the nadir.

And, what good is a trip without good food? On Sunday night, 11 of us went to do some fine dining at the Lone Eagle Grille. The food was fantastic, and the service was great. I finally got to try some elk, which I've been wanting to try for some time now.

Here are the food pictures...

That's it... and, now here I am still at work (but, taking a short break).

Subscribe to:

Posts (Atom)