In an effort to reduce my effective basis on Apple (AAPL), I picked up a couple more pieces of AAPL at 74.17 and 73.94. Will unwind these extra positions as we move higher, or the positions will get stopped out at 73.50.

*** Edit #1: Exited one piece just now at 75.24.

*** Edit #2: The other piece was just sold at 75.67. So, we are back to our original position at a much lower cost basis. Will calculate and update in a future post.

*** Edit #3: Spud jumped in to play some Google (GOOG) in anticipation of its earnings to be released shortly after market close... In a show of support, I decided to throw out a small gamble and picked up a single Feb 430 call contract at 28.40. If GOOG moves up, great. If not, them's the breaks.

Main Page: bruteforcex.blogspot.com

Random posts about anything I've found interesting.

Contact Me: BruteForceXYZ (at) hotmail (dot) com

Tuesday, January 31, 2006

Monday, January 30, 2006

Quick Updates

Juniper Networks (JNPR) sold for a loss in the mid-17's last Friday. Today, picked up a fresh new block of Apple (AAPL) at 72.25 this morning. The stock finally caught a bid, and I exited at 74.50. This decreases the cost basis on the remaining Apple position to 74.52. This does not include the $1.20 I threw at the bull spread.

Eastman Kodak (EK) posted earnings today. I didn't think the report was all that bad. Shares are down on the report, however.

And, the ERR party was absolutely off the hook. Some pictures will be coming soon (I hope).

Eastman Kodak (EK) posted earnings today. I didn't think the report was all that bad. Shares are down on the report, however.

And, the ERR party was absolutely off the hook. Some pictures will be coming soon (I hope).

Friday, January 27, 2006

The Next Few Days

First thing's first... there's a worm in my Apple (AAPL). My entry in the 77's isn't looking so hot right now. But, I was able to shave off about 70 cents from my cost basis, so we're looking at 76.50 or so. I was able to shave some off by selling shares and then buying them back cheaper with the full intention of buying them back even if it meant I had to buy it back a little bit higher. Fortunately, that didn't happen. Also, you have no idea how relieved I am to have taken the Broadcom (BRCM) loss at 57. Today, the company announced one of the most spectacular quarters, and the stock finished trading afterhours over $70. Naz futures are up nicely at this hour, and the Nikkei posted a rather sick gain of nearly 570 points (or nearly 3.6%). Finally, Juniper Networks (JNPR) was a thorn in my portfolio today... I'll be looking to take a loss in that position soon and be done with it.

Ok, enough stock talk.

Tomorrow, my good friend, Spud, flies in to town from SoCal. He'll be here for the weekend to attend the Last ERR Party Ever, aptly named Apocalypse Ranch (entire list of video invitations here). This party has gotten a ton of hype, and I am quite confident that it will live up to it, and then some.

Here's a snippet from an e-mail I received from one of the original ERR guys:

TONS of people are flying in for the party. It certainly has all the opportunity to be our greatest party to date.

When people are willing to fly cross-country for a single party, you gotta believe it's going to rock.

On Saturday, another SoCal partygoer will be arriving... Ms. Mt. Fuji. Here's the current parlay... She promises to get really trashed and not jump all over any of my friends when in a drunken state. I'll lay 2 to 1 odds against. Just kidding... I'm sure she'll behave, but she is a ton of fun and the ERR is going to be a better place with her there.

I'm really quite pumped up about this weekend. It is really going to be supercharged. I also feel a bit sad that the ridiculous string of the most ridiculously good parties is all coming to a most ridiculous end.

Ok, enough stock talk.

Tomorrow, my good friend, Spud, flies in to town from SoCal. He'll be here for the weekend to attend the Last ERR Party Ever, aptly named Apocalypse Ranch (entire list of video invitations here). This party has gotten a ton of hype, and I am quite confident that it will live up to it, and then some.

Here's a snippet from an e-mail I received from one of the original ERR guys:

TONS of people are flying in for the party. It certainly has all the opportunity to be our greatest party to date.

When people are willing to fly cross-country for a single party, you gotta believe it's going to rock.

On Saturday, another SoCal partygoer will be arriving... Ms. Mt. Fuji. Here's the current parlay... She promises to get really trashed and not jump all over any of my friends when in a drunken state. I'll lay 2 to 1 odds against. Just kidding... I'm sure she'll behave, but she is a ton of fun and the ERR is going to be a better place with her there.

I'm really quite pumped up about this weekend. It is really going to be supercharged. I also feel a bit sad that the ridiculous string of the most ridiculously good parties is all coming to a most ridiculous end.

Tuesday, January 24, 2006

Trade Update

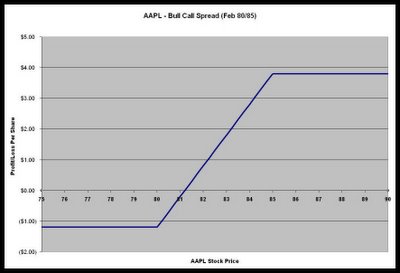

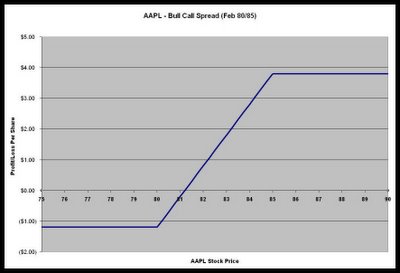

Boosting my exposure to Apple (AAPL) via a Bull Call Spread established today for a debit of $1.20 per contract. For those unfamiliar with this option spread, it is the purchase of call options at some strike price and the sale of call options on the same security at a higher strike price.

In this particular trade, I went long the Feb 80's for $2.20 and short the Feb 85's for $1.00.

The spread expires on February 17. So, I basically need AAPL to move into the profitable range by then. The spread limits both upside and downside. Ignoring transaction costs, break-even for this spread is at AAPL equal to $81.20. Here's a profit-loss diagram for the spread I entered into today. (Click Image to Enlarge)

In this particular trade, I went long the Feb 80's for $2.20 and short the Feb 85's for $1.00.

The spread expires on February 17. So, I basically need AAPL to move into the profitable range by then. The spread limits both upside and downside. Ignoring transaction costs, break-even for this spread is at AAPL equal to $81.20. Here's a profit-loss diagram for the spread I entered into today. (Click Image to Enlarge)

Monday, January 23, 2006

Gotta Talk About Gotta

This might be really obvious to some of you, but it struck me recently that not everyone knows what words gotta replaces.

There are some who believe that gotta replaces "got to." But, the truth is that gotta stands for "have got to."

"I gotta go to the movies." IS EQUIVALENT TO "I have got to go to the movies." AND NOT EQUIVALENT TO "I got to go to the movies," which means something completely different.

"Got To" means "was able to," whereas "Have/Has Got To" holds a meaning much closer to "must."

A pretty mundane observation, really... but it was a real source of confusion the other day when I was chatting with a friend online. Just wanted to straighten everyone out.

There are some who believe that gotta replaces "got to." But, the truth is that gotta stands for "have got to."

"I gotta go to the movies." IS EQUIVALENT TO "I have got to go to the movies." AND NOT EQUIVALENT TO "I got to go to the movies," which means something completely different.

"Got To" means "was able to," whereas "Have/Has Got To" holds a meaning much closer to "must."

A pretty mundane observation, really... but it was a real source of confusion the other day when I was chatting with a friend online. Just wanted to straighten everyone out.

Saturday, January 21, 2006

The Weekend

So, I celebrated my birthday at Sushi Ran in Sausilito. Let me tell you how awesome the sushi was here. The fish was so incredibly fresh, and the selection was pretty good. The GF found this spot in the latest Zagat Survey. We've been having fairly good luck with the Zagat recommendations. The restaurant is my new top pick for sushi in the San Francisco Bay Area. We were in such a rush to make it to our reservation on time that we forgot to bring the camera, so there are no pictures of the food unfortunately.

For those that don't want to travel too far for sushi, I recommend Yuki Sushi in Santa Clara. And, by all means avoid any sushi place run by Chinese people in the South Bay. Each and every one that I have tried has been a horrible disappointment. I mean they can barely pass in the cooked Japanese food department, but when it comes to anything raw, they really should give it up. It's really a shame when people new to sushi eat at their establishments. I would not be surprised if many are turned off by the food forever.

On Saturday, we hit up Pizza Depot in Fremont. After stuffing ourselves with pizza, we headed to the man-made Lake Elizabeth in Fremont's Central Park. It's nice to walk around there if you are keenly aware of the goose and duck droppings that are sprinkled all over the area. Did you know that an adult goose can produce half a pound or more fecal matter each day? That's pretty gross.

Last night, we tried a brand new restaurant that opened up at the nearby Ulferts Center off Barber Lane called Thai Cafe. The food was average at best. The modern look of the restaurant was nice, and I felt their service was good. If only the food was less bland. Nothing really stood out.

Not sure what is in store for us today. I think I'm going to find a place using Jason and Terry's Bay Area Reviews. I've never used their guide, but I've heard it's pretty reliable. I think today's the day to give it a try. Maybe something quick so that we can get back and catch the rest of the Denver-Pittsburgh game.

For those that don't want to travel too far for sushi, I recommend Yuki Sushi in Santa Clara. And, by all means avoid any sushi place run by Chinese people in the South Bay. Each and every one that I have tried has been a horrible disappointment. I mean they can barely pass in the cooked Japanese food department, but when it comes to anything raw, they really should give it up. It's really a shame when people new to sushi eat at their establishments. I would not be surprised if many are turned off by the food forever.

On Saturday, we hit up Pizza Depot in Fremont. After stuffing ourselves with pizza, we headed to the man-made Lake Elizabeth in Fremont's Central Park. It's nice to walk around there if you are keenly aware of the goose and duck droppings that are sprinkled all over the area. Did you know that an adult goose can produce half a pound or more fecal matter each day? That's pretty gross.

Last night, we tried a brand new restaurant that opened up at the nearby Ulferts Center off Barber Lane called Thai Cafe. The food was average at best. The modern look of the restaurant was nice, and I felt their service was good. If only the food was less bland. Nothing really stood out.

Not sure what is in store for us today. I think I'm going to find a place using Jason and Terry's Bay Area Reviews. I've never used their guide, but I've heard it's pretty reliable. I think today's the day to give it a try. Maybe something quick so that we can get back and catch the rest of the Denver-Pittsburgh game.

Friday, January 20, 2006

Quick Update

Covered the Synaptics (SYNA) short position at 25.59 today. Cost basis of short was 30.65, so that was good for a $5 hit. Then, went long Apple (AAPL) at 77.22.

Added a position in Fortune Brands (FO) at 77.81 to the Long Term portfolio.

Added a position in Fortune Brands (FO) at 77.81 to the Long Term portfolio.

Thursday, January 19, 2006

Today's Trade Update

In the morning, I had contemplated going long some Motorola (MOT) into its earnings release after market close, but it kept running higher. So, I was scared off of it.

Instead, as the market approached closing, I put in an order to short Synaptics (SYNA) going into its earnings release. I was so caught up with stuff here at work, I didn't even realize my order had been filled. For now, I'm glad it did. Synaptics dropped about 10% after its earnings announcement. The upcoming conference call and tomorrow's trading action will paint a clearer picture. I will review the conference call replay later on, and decide whether or not I want to hold this short.

The position was quite a bit smaller than the Broadcom (BRCM) position (I'm obviously a bit gunshy). So, this only makes back a fraction of what was lost in that debacle of a trade.

On a different note... EBAY ran up a bit today after it posted its earnings last night. Hopefully, the stock will stay below 47.50 by tomorrow's close allowing the call options I wrote on the position to expire worthless. If that happens, I will have to decide if I want to write another round or not. If not, then my shares will be called away for an effective sale price of 49.25 ($1.75 collected from each call option).

Instead, as the market approached closing, I put in an order to short Synaptics (SYNA) going into its earnings release. I was so caught up with stuff here at work, I didn't even realize my order had been filled. For now, I'm glad it did. Synaptics dropped about 10% after its earnings announcement. The upcoming conference call and tomorrow's trading action will paint a clearer picture. I will review the conference call replay later on, and decide whether or not I want to hold this short.

The position was quite a bit smaller than the Broadcom (BRCM) position (I'm obviously a bit gunshy). So, this only makes back a fraction of what was lost in that debacle of a trade.

On a different note... EBAY ran up a bit today after it posted its earnings last night. Hopefully, the stock will stay below 47.50 by tomorrow's close allowing the call options I wrote on the position to expire worthless. If that happens, I will have to decide if I want to write another round or not. If not, then my shares will be called away for an effective sale price of 49.25 ($1.75 collected from each call option).

Wednesday, January 18, 2006

Stopping the Bleeding

I've taken my substantial loss in the Broadcom (BRCM) short today. I've closed out the entire position in the 57.03 to 57.10 range.

As Teddy KGB would say...

Nyet! Nyet! No More!

This son of bitch, each day Up Up Up.

It trapped me.

Time to regain focus and look for new opportunities. Gave up the original BRCM gains and then some on this recent blunder.

As Teddy KGB would say...

Nyet! Nyet! No More!

This son of bitch, each day Up Up Up.

It trapped me.

Time to regain focus and look for new opportunities. Gave up the original BRCM gains and then some on this recent blunder.

Tuesday, January 17, 2006

Let's Make A Fortune

Recently, I have been looking to add more vice to my long-term portfolio. Everyone needs a little bit of vice in their lives. After some digging, I believe I have found a reasonably valued company in Fortune Brands (FO). They are a conglomerate with three main lines of business: Home & Hardware, Golf Products, and Wines & Spirits.

Their Wine & Spirits portfolio contains some pretty strong brands... Jim Beam, Courvoisier, Maker's Mark, Clos du Bois, Knob Creek, and Sauza to name a few. This group accounts for roughly a third of FO's revenues. According to a Credit Suisse First Boston report dated 16 December 2005, their high-end brands are gaining market share, and their recently acquired brands (Maker's and Sauza) are picking up steam.

The Home & Hardware business is their largest one. It has strong brands as well. Most of you have heard of Master Lock, and those with houses have probably heard of Moen, America's #1 selling faucet brand.

I don't know much about golf, but from what I can tell, their golf products are well received. They own such brands as Cobra and Titleist. As more and more baby boomers reach retirement, the golf industry should do well over time. The longer-term trend looks is clearly up, as measured by number of rounds played.

The valuation of FO looks reasonable, which is what attracts me to this company. A quick look shows it sports a P/E of about 17, and if we assume that next year's earnings estimates are accurate, then it has a forward P/E below 15. According to the CSFB report, FO has a 3-year median P/E around 16. The company produces a ton of Free Cash Flow, and also pays out an annual dividend yielding 1.85% at today's price of $78 a share. It also has a history of increasing its dividend every 9 to 12 months.

The primary danger is the housing market slowdown, which could potentially lead to a slowdown in the Home business. FO's ability to preserve its margins is also something to keep a watchful eye on.

I think I'm a buyer here in the $75-80 range. Not sure when I will pull the trigger, but I'm guessing soon.

Their Wine & Spirits portfolio contains some pretty strong brands... Jim Beam, Courvoisier, Maker's Mark, Clos du Bois, Knob Creek, and Sauza to name a few. This group accounts for roughly a third of FO's revenues. According to a Credit Suisse First Boston report dated 16 December 2005, their high-end brands are gaining market share, and their recently acquired brands (Maker's and Sauza) are picking up steam.

The Home & Hardware business is their largest one. It has strong brands as well. Most of you have heard of Master Lock, and those with houses have probably heard of Moen, America's #1 selling faucet brand.

I don't know much about golf, but from what I can tell, their golf products are well received. They own such brands as Cobra and Titleist. As more and more baby boomers reach retirement, the golf industry should do well over time. The longer-term trend looks is clearly up, as measured by number of rounds played.

The valuation of FO looks reasonable, which is what attracts me to this company. A quick look shows it sports a P/E of about 17, and if we assume that next year's earnings estimates are accurate, then it has a forward P/E below 15. According to the CSFB report, FO has a 3-year median P/E around 16. The company produces a ton of Free Cash Flow, and also pays out an annual dividend yielding 1.85% at today's price of $78 a share. It also has a history of increasing its dividend every 9 to 12 months.

The primary danger is the housing market slowdown, which could potentially lead to a slowdown in the Home business. FO's ability to preserve its margins is also something to keep a watchful eye on.

I think I'm a buyer here in the $75-80 range. Not sure when I will pull the trigger, but I'm guessing soon.

Sunday, January 15, 2006

Bread Crusts, Poker, and Forbidden China

I have never preferred bread crust over the bread white. If I had to choose between an end or a middle section of a bread loaf, I would most certainly opt for a middle piece. I think most people fall into the same category as me. But, I do know someone who prefers the ends.

That same person also prefers harder, crunchier foods over soft foods. I know that I generally like softer foods. I wonder if there's a connection there. Anyway, I just thought about this a bit today while eating a tasty omelette at one of my favorite local breakfast places, Omega Coffee Shop. Maybe there's no correlation at all between preferring soft foods and preferring bread white. Maybe for the most part it has to do with taste. I have no idea, but that's pretty much what I thought about this morning as the Colts were getting their ass kicked by the Steelers.

Been playing on Full Tilt Poker recently. I signed up a week ago. They're offering a $600 bonus. Seems ridiculously hard to clear the bonus if you play anything less than $3/6. But, if you play at $5/10 and higher, the bonus can be cleared without too much difficulty. The games are not so bad. Definitely softer than Poker Stars, but not quite as juicy as the games on Party. I did fool around a bit playing $1/2 Razz. It was fun. I don't know much about strategy, but I did read a little bit about the game before I jumped in to play. I did okay, but I doubt the game will become anything more than an occasional diversion.

The main gripe about Full Tilt Poker is that their damn system goes down more often than it should. I think they are working on this stability issue, but if the problems continue, I'll have no choice but to stop playing there. Many pros get play on their site, and when they do play, the table in which they are seated is highlighted. Huck Seed was at my $10/20 table the other night, which was pretty cool. I only tangled with him once, and I outflopped him with K9 suited in the small blind versus his AJ offsuit in the big blind. So, I guess versus ex-World Series of Poker champions, I am net positive. Ha ha.

Ok, I'll end this with a couple of pictures from the China trip. If you ever get a chance to hike the Great Wall in an area not populated by tourists, be sure not to go the wrong way. Obey the rules of the road...

(Click Pictures to Enlarge)

... or face the consequences.

That same person also prefers harder, crunchier foods over soft foods. I know that I generally like softer foods. I wonder if there's a connection there. Anyway, I just thought about this a bit today while eating a tasty omelette at one of my favorite local breakfast places, Omega Coffee Shop. Maybe there's no correlation at all between preferring soft foods and preferring bread white. Maybe for the most part it has to do with taste. I have no idea, but that's pretty much what I thought about this morning as the Colts were getting their ass kicked by the Steelers.

Been playing on Full Tilt Poker recently. I signed up a week ago. They're offering a $600 bonus. Seems ridiculously hard to clear the bonus if you play anything less than $3/6. But, if you play at $5/10 and higher, the bonus can be cleared without too much difficulty. The games are not so bad. Definitely softer than Poker Stars, but not quite as juicy as the games on Party. I did fool around a bit playing $1/2 Razz. It was fun. I don't know much about strategy, but I did read a little bit about the game before I jumped in to play. I did okay, but I doubt the game will become anything more than an occasional diversion.

The main gripe about Full Tilt Poker is that their damn system goes down more often than it should. I think they are working on this stability issue, but if the problems continue, I'll have no choice but to stop playing there. Many pros get play on their site, and when they do play, the table in which they are seated is highlighted. Huck Seed was at my $10/20 table the other night, which was pretty cool. I only tangled with him once, and I outflopped him with K9 suited in the small blind versus his AJ offsuit in the big blind. So, I guess versus ex-World Series of Poker champions, I am net positive. Ha ha.

Ok, I'll end this with a couple of pictures from the China trip. If you ever get a chance to hike the Great Wall in an area not populated by tourists, be sure not to go the wrong way. Obey the rules of the road...

(Click Pictures to Enlarge)

... or face the consequences.

Saturday, January 14, 2006

Texas Roadhouse

So, I've been a fan of Texas Roadhouse, a restaurant located nearby in Union City. Apparently it is a national chain, but has a lot of room for expansion. To put this into perspective, there are only two locations in California. The other is located in Elk Grove. It's not a fancy place, but the food is great. For those of you who like the food at Claim Jumper, you definitely want to give Texas Roadhouse a try if you are in the San Francisco Bay Area. I think the food wins hands down.

The only gripe I have is that every time I have been, the wait is ridiculously long (2 hours+ on weekends). They don't accept reservations, but at least they do allow call-ahead seating. If they didn't, I would never eat there. I am not that patient. Anyway, I went last night and the food was great as always. They provided too much as usual... so, plenty of leftovers for tonight.

Anyway, the company is public. The valuation is quite high, but my speculative juices are flowing, and I am seriously considering taking a position in it. It would be a smallish position if anything. Have a look, and let me know your thoughts privately or publicly. Texas Roadhouse trades on the Nasdaq under the ticker TXRH.

The only gripe I have is that every time I have been, the wait is ridiculously long (2 hours+ on weekends). They don't accept reservations, but at least they do allow call-ahead seating. If they didn't, I would never eat there. I am not that patient. Anyway, I went last night and the food was great as always. They provided too much as usual... so, plenty of leftovers for tonight.

Anyway, the company is public. The valuation is quite high, but my speculative juices are flowing, and I am seriously considering taking a position in it. It would be a smallish position if anything. Have a look, and let me know your thoughts privately or publicly. Texas Roadhouse trades on the Nasdaq under the ticker TXRH.

Tuesday, January 10, 2006

Another Quick Update

I sold off the IAC Interactive (IACI) shares today in the 29.10's. I am growing a bit bearish given current market conditions. Feeling the pain on the Broadcom (BRCM) short. Still holding onto the short, for better or worse.

Monday, January 09, 2006

Quick Update

Sold Expedia (EXPE) at 23.97. Established a short position in Broadcom (BRCM) at 52.65 in the Trading Portfolio.

Market sentiment is extremely bullish right now, and that is usually a sign that things will cool off. Remember that market sentiment is generally a contrarian indicator. The underlying logic is... when everyone is bullish, who else is left to buy? Likewise, when everyone is bearish, who has anything left to sell?

BRCM is one heck of a mover, so I will keep a close watch on it. If I need to I will cover for a minor loss quickly.

New on the Watch List: Suntech Power (STP) - A solar play for China.

Market sentiment is extremely bullish right now, and that is usually a sign that things will cool off. Remember that market sentiment is generally a contrarian indicator. The underlying logic is... when everyone is bullish, who else is left to buy? Likewise, when everyone is bearish, who has anything left to sell?

BRCM is one heck of a mover, so I will keep a close watch on it. If I need to I will cover for a minor loss quickly.

New on the Watch List: Suntech Power (STP) - A solar play for China.

B-School, Expedia, and a Useless Object

Well, many of you know that I've been quite busy with Business School applications. As of 10 minutes ago, with the exception of proofreading and essay polishing, I am now completely done with the third and final application. The other two applications were due earlier in the week, and have since been submitted. I hope to hear back from the schools soon. Since I only applied to three, the admission statistics tell me that there's a serious chance that I get into none of them.

On a different note, I am going to be selling Expedia (EXPE) from the Trading Portfolio. Recall that EXPE was a spin-off from IAC Interactive (IACI), which I obtained as a result of its purchase of Ask Jeeves (ASKJ).

Oil is still in the mid-60's, and while many are hoping the travel industry picking up, I am not so sure. I will be selling into the run-up the stock has enjoyed since it bottomed in November. These gains will be taxed at the lower long-term rate, since I first purchased ASKJ over a year ago.

And here's the useless object for the day... my very own Lava Lamp. Not sure it really helps the room at all, but it's new so I've been keeping it on at night lately.

On a different note, I am going to be selling Expedia (EXPE) from the Trading Portfolio. Recall that EXPE was a spin-off from IAC Interactive (IACI), which I obtained as a result of its purchase of Ask Jeeves (ASKJ).

Oil is still in the mid-60's, and while many are hoping the travel industry picking up, I am not so sure. I will be selling into the run-up the stock has enjoyed since it bottomed in November. These gains will be taxed at the lower long-term rate, since I first purchased ASKJ over a year ago.

And here's the useless object for the day... my very own Lava Lamp. Not sure it really helps the room at all, but it's new so I've been keeping it on at night lately.

Friday, January 06, 2006

Portfolio Checkpoint - 2005 Q4

This post is probably more for my own recordkeeping purposes, but some of you might find it interesting to see the current (long-term) portfolio and how it changes the next time I mark a day as a checkpoint.

January 6, 2006 - Market Close

Long-Term Portfolio (listed in order of position size)

1) Altria Group - MO - 20.3%

2) Harrah's Entertainment - HET - 10.7%

3) Student Loan Corp. - STU - 8.8%

4) General Electric - GE - 7.3%

5) Constellation Brands - STZ - 6.5%

6) Eastman Kodak - EK - 4.9%

7) American Eagle Outfitters - AEOS - 4.8%

8) International Gaming Technology - IGT - 4.6%

9) Capital One Financial - COF - 4.0%

10) Amgen - AMGN - 3.9%

11) Linear Technology - LLTC - 3.8%

12) North Fork Bancorp - NFB - 3.3%

13) First Marblehead Corp. - FMD - 3.1%

14) St. Jude Medical - STJ - 2.6%

15) Dow Chemical - DOW - 2.2%

16) Juniper Networks - JNPR - 2.2%

17) Sun Bancorp - SNBC - 2.0%

18) Equity Office Properties - EOP - 1.8%

19) Finish Line - FINL - 1.7%

20) Khongzhong Corp. - KONG - 1.5%

* Percentages do not reflect any cash held in the Portfolio

January 6, 2006 - Market Close

Long-Term Portfolio (listed in order of position size)

1) Altria Group - MO - 20.3%

2) Harrah's Entertainment - HET - 10.7%

3) Student Loan Corp. - STU - 8.8%

4) General Electric - GE - 7.3%

5) Constellation Brands - STZ - 6.5%

6) Eastman Kodak - EK - 4.9%

7) American Eagle Outfitters - AEOS - 4.8%

8) International Gaming Technology - IGT - 4.6%

9) Capital One Financial - COF - 4.0%

10) Amgen - AMGN - 3.9%

11) Linear Technology - LLTC - 3.8%

12) North Fork Bancorp - NFB - 3.3%

13) First Marblehead Corp. - FMD - 3.1%

14) St. Jude Medical - STJ - 2.6%

15) Dow Chemical - DOW - 2.2%

16) Juniper Networks - JNPR - 2.2%

17) Sun Bancorp - SNBC - 2.0%

18) Equity Office Properties - EOP - 1.8%

19) Finish Line - FINL - 1.7%

20) Khongzhong Corp. - KONG - 1.5%

* Percentages do not reflect any cash held in the Portfolio

Quick Trade and Market Update

The market has really been on a heater in the first week of '06.

Don't want to be too greedy. I have exited Broadcom (BRCM) in full at 50.33, just shy of a $3 winner.

Played some Nuvelo (NUVO) on the short side for a small profit today as well. They surged more than 40% yesterday due to a large drug deal with Bayer. After spiking some more today, it began to weaken. So, I shorted a bit and was able to cover fairly quickly.

Yesterday, Constellation Brands (STZ) announced fine earnings, except they guided their revenue projections a bit lower than most expected prompting a sell-off in shares.

Today, Piper Jaffray upgraded St. Jude Medical (STJ) to Outperform and tacking on a $60 price target. STJ gained market share in Implanted Cardiac Defibrillators due to Guidant's recent problems. Piper believes that their market share gain is sustainable.

That's all for now.

Don't want to be too greedy. I have exited Broadcom (BRCM) in full at 50.33, just shy of a $3 winner.

Played some Nuvelo (NUVO) on the short side for a small profit today as well. They surged more than 40% yesterday due to a large drug deal with Bayer. After spiking some more today, it began to weaken. So, I shorted a bit and was able to cover fairly quickly.

Yesterday, Constellation Brands (STZ) announced fine earnings, except they guided their revenue projections a bit lower than most expected prompting a sell-off in shares.

Today, Piper Jaffray upgraded St. Jude Medical (STJ) to Outperform and tacking on a $60 price target. STJ gained market share in Implanted Cardiac Defibrillators due to Guidant's recent problems. Piper believes that their market share gain is sustainable.

That's all for now.

Thursday, January 05, 2006

Who Wants To Be A Millionaire?

Yes, it's a borderline retarded idea... but, the kid made a million bucks. More power to him.

Here's the idea. Set aside 1 million pixels worth of space on your homepage. Sell each pixel for $1. Sell out, and you make yourself a million bucks.

Click Here To Go To The Million Dollar Homepage

Got quite a bit of media coverage recently. Anyway, I found it interesting. Check it out.

Here's the idea. Set aside 1 million pixels worth of space on your homepage. Sell each pixel for $1. Sell out, and you make yourself a million bucks.

Click Here To Go To The Million Dollar Homepage

Got quite a bit of media coverage recently. Anyway, I found it interesting. Check it out.

Wednesday, January 04, 2006

American Eagle Outfitters SSS

Same store sales numbers for the month of December are out for American Eagle Outfitters (AEOS). The company saw 9.8% growth in stores open for at least a year. A great number when compared to the paltry 3.5% expected by the Street.

The question now is whether or not they were able to preserve their margins. If the strong sales figures are a result of large markdowns, then the stock might suffer. From my own visits to the mall, I haven't seen it... all anecdotal, of course, but better than nothing.

For now, I'll enjoy the moment... AEOS up 7.5% afterhours to 24.50.

The question now is whether or not they were able to preserve their margins. If the strong sales figures are a result of large markdowns, then the stock might suffer. From my own visits to the mall, I haven't seen it... all anecdotal, of course, but better than nothing.

For now, I'll enjoy the moment... AEOS up 7.5% afterhours to 24.50.

Tuesday, January 03, 2006

First Trade of 2006

So, I initiated my first trading position for 2006. I grabbed a block of Broadcom (BRCM) today at 47.45. Will be watching closely. Will get out for a loss at 46 or so, if it comes to that.

Anyway, the stock market caught a nice break after the release of the Fed's meeting minutes suggesting that the rate hikes are almost over. If the markets continue to move sharply, I will be selling covered calls on some longer-term holdings and possibly unloading some of the positions in the Trading Portfolio.

2006 is off to a good start. Happy trading to all of you.

I am hearing that my buddy, Spud, might be entering the game soon. Sounds like he's a bit bearish and looking to short. I'll let you all know when he makes a move.

Anyway, the stock market caught a nice break after the release of the Fed's meeting minutes suggesting that the rate hikes are almost over. If the markets continue to move sharply, I will be selling covered calls on some longer-term holdings and possibly unloading some of the positions in the Trading Portfolio.

2006 is off to a good start. Happy trading to all of you.

I am hearing that my buddy, Spud, might be entering the game soon. Sounds like he's a bit bearish and looking to short. I'll let you all know when he makes a move.

Monday, January 02, 2006

China, Stocks, and the New Year

So, here are a couple of pictures from the China trip. I'll be uploading the entire collection on some online web album thing soon.

Yes, I tried Scorpions in China.

A beautiful shot of the Great Wall in a not-so-touristy area.

As far as stocks go... I did end up picking up the shares of American Eagle Outfitters (AEOS) at a price of 22.99. Hope to see it move in the upcoming year. It reports its December numbers in a few days.

Last year was a fine one for the stock portfolios. Here is the final scoreboard for 2005.

S&P 500: +3.00%

S&P 500 Total Return: +4.91%

Long-Term Portfolio: +6.92%

Trading Portfolio: +61.27%

Understand that the Trading Portfolio is a much smaller portfolio where I take on much larger risk for potentially large returns. The Trading Portfolio was greatly helped by a couple of lucky large moves in RF Micro Devices and eBay. One more thing to note is that the S&P 500 Total Return is what really should be benchmarked against since it includes the reinvestment of dividends.

The last day of 2005 sucked for me. I attended an overpriced party in San Francisco. The food wasn't all that good, the crowd was generally rude, and half of our party got a bit too drunk. It was not a fun night.

As for the new year, I think that I want to learn Mandarin. So, my resolution this year will be to try and get to a really basic conversational level in the language. Even if my language isn't quite proper, that'll be okay. I just want to know enough to be able to get by if there were no English speakers. Maybe that's not even possible in that short a time, but I'll give it my best shot.

Happy New Year to all of you.

As far as stocks go... I did end up picking up the shares of American Eagle Outfitters (AEOS) at a price of 22.99. Hope to see it move in the upcoming year. It reports its December numbers in a few days.

Last year was a fine one for the stock portfolios. Here is the final scoreboard for 2005.

S&P 500: +3.00%

S&P 500 Total Return: +4.91%

Long-Term Portfolio: +6.92%

Trading Portfolio: +61.27%

Understand that the Trading Portfolio is a much smaller portfolio where I take on much larger risk for potentially large returns. The Trading Portfolio was greatly helped by a couple of lucky large moves in RF Micro Devices and eBay. One more thing to note is that the S&P 500 Total Return is what really should be benchmarked against since it includes the reinvestment of dividends.

The last day of 2005 sucked for me. I attended an overpriced party in San Francisco. The food wasn't all that good, the crowd was generally rude, and half of our party got a bit too drunk. It was not a fun night.

As for the new year, I think that I want to learn Mandarin. So, my resolution this year will be to try and get to a really basic conversational level in the language. Even if my language isn't quite proper, that'll be okay. I just want to know enough to be able to get by if there were no English speakers. Maybe that's not even possible in that short a time, but I'll give it my best shot.

Happy New Year to all of you.

Subscribe to:

Posts (Atom)