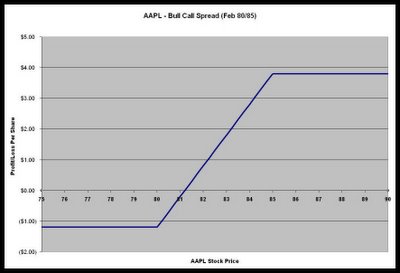

In this particular trade, I went long the Feb 80's for $2.20 and short the Feb 85's for $1.00.

The spread expires on February 17. So, I basically need AAPL to move into the profitable range by then. The spread limits both upside and downside. Ignoring transaction costs, break-even for this spread is at AAPL equal to $81.20. Here's a profit-loss diagram for the spread I entered into today. (Click Image to Enlarge)

No comments:

Post a Comment