Main Page: bruteforcex.blogspot.com

Random posts about anything I've found interesting.

Contact Me: BruteForceXYZ (at) hotmail (dot) com

Thursday, December 29, 2005

Stocks and More

Compare AEOS with a P/E of 12.5 against ANF with a P/E of 25. AEOS operating profit margin over 20% and ANF's at around 18%. AEOS is currently distributing a dividend yielding 1.4% compard to ANF's 1.1%. If we're to assume that analyst earnings projections are accurate (they're often not), AEOS forward P/E is under 11, ANF's is looking to be about 17. So, the growth estimates for ANF are clearly stronger, but if the retail sector moves as a whole, then AEOS should outperform many of its peers in my estimation.

So, I've put in an order to establish a position in AEOS just around the closing market price. Hopefully, the order will be filled. I'll be on the plane during market hours, so I won't know if I am an owner of AEOS or not until I get back.

Also, don't you hate getting out of a losing trading position only to see it rocket back up for substantial profits shortly after? Ugh. Remember the 10% or so loss I took on Under Armour (UARM)? Well, had I still owned it, I would have rung up a more than a 50% gain instead. You win some, and you lose some.

Looks like I'll be beating the S&P this year. With only one more trading day to go, I'm up on it by enough that unless something drastic happens, I should hold my lead. Final year results will be posted up later. A big China post will come soon after my trip as well.

Ok, time to stop rambling, I'm just a bit bored... I have another half hour or so before we catch a cab to the airport.

One final remark... Shanghai people are ridiculously rude and aggressive. Makes New Yorkers seem like the nicest people ever. And, it makes us Californians seem like total wimps.

Tuesday, December 27, 2005

Shanghai

Lots more about this trip to come...

For now, I'll put up my OK Cupid Politics Test Results. It seems that everyone else is doing it.

| You are a Social Liberal (68% permissive) and an... Economic Conservative (85% permissive) You are best described as a:

Link: The Politics Test on Ok Cupid Also: The OkCupid Dating Persona Test |

Wednesday, December 21, 2005

A Shout From The Other Side

Thursday, December 15, 2005

Supreme Court Ruling

Illinois Supreme Court reverses

$10.1 billion Altria verdict

In other news... First Marblehead (FMD) took a nasty plunge today as JP Morgan Chase (JPM) decided to buy Collegiate Funding Services Inc. (CFSI). While I see no official news on FMD, I am sure that this is the reason for the drop. With this acquisition, JPM might steer the business it gave FMD in-house.

Wednesday, December 14, 2005

With The Lights Out

Tomorrow is a very big day for Altria (MO). The infamous "Lights" case (formally known as Price vs. Philip Morris USA) is going to get a ruling tomorrow morning. If it goes well for MO, then we should expect to hear more from the company about its break-up. If not, well, I'm going to be in for some pain, since MO is currently my largest position.

For those of you who enjoy reading about important legal trials... here's a link to the "Lights" case.

Monday, December 12, 2005

High and Dry

After the sale, this brings the cash position of this portfolio to just over 5%. Still eyeing Abercrombie & Fitch (ANF). Would like to see it pull back below 60, but I might nibble at it sooner.

Been reading Joel Greenblatt's books lately. Maybe some of his value-oriented insights will help guide me in my next purchase.

Friday, December 09, 2005

The Reverse Password

Why don't we see more use of the Reverse Password? Some sites have already begun doing this, but it's really quite rare from what I've seen. The Reverse Password is a simple scheme... when you first enroll or create an account, you specify a login name, a primary password, a secondary password, and also a reverse password of your choosing. The secondary password can be as simple as an answer to one of the standard "identify yourself" questions (e.g. What is your mother's maiden name?, What is your favorite hobby?, etc).

Now, when you log into the site, you enter your username and primary password. You are then shown the reverse password, which ensures that the site is the same one that you think it is. Finally, you are asked to enter a secondary password to gain access to your account. One benefit is that if you are ever given an incorrect reverse password, you can immediately get in touch with the site you are trying to access to let them know of a potential security breach.

Maybe the reason this hasn't gotten too popular is that it is too complicated a process, but I feel that it makes sense. Recently, Bank of America has implemented a Reverse Password scheme. It isn't exactly like the one I described, but it more or less accomplishes the same thing in a similar fashion. A quick description of how their system works can be found by clicking here.

What do you think? Have any sites you frequent begun using a Reverse Password?

Thursday, December 08, 2005

Conservation of Joy

When someone dies a lot of sadness is brought to the world. People are touched and are saddened by the loss. Direct and indirect sadness is released, similar to the case of joy in the event of a birth.

Assuming sadness is loss of joy, is Joy more or less conserved in the world? So we have Joy Inflow and Joy Outflow. It seems that more Joy is lost when someone passes than is brought when they are born. If this is the case, then is the world doomed to grow sadder and sadder each day?

So, I just spoke with Ms. Mt. Fuji (MMF) a little bit. MMF brought up the fact that a person continues to bring joy during his or her lifetime, but that new joy is somewhat reduced by the new sadness that is created due to their lives, too. So, the Flow of Joy is ongoing and the sharp loss of Joy due to death is a one-time event. In the case of a bad person the Joy Flow during life and death are negated, but the Joy from birth likely remains a positive.

What do we have here... for the typical person, we have Net_Joy = Joy_Birth + Joy_Life + Joy_Death. Joy_Birth is positive, Joy_Death is negative, and Joy_Life is slightly positive/negative depending how they lived their lives. Anyway, this brings me to the same question... is Joy (in this new view) conserved? Is the world growing sadder, happier, or maintaining an equilibrium?

Okay, more rambling here. There exists a National Joy Index (NJI)... the Rwandan NJI is obviously very low. America's is substantially higher. Now, we also have a World Joy Index (WJI) that is a weighted average of all the NJIs. What happens when the WJI drops too low? Will the world enter into a seriously disruptive state? Can there be serious consequences for the other extreme if the WJI spikes way up?

Tuesday, December 06, 2005

Trading Update

Still got my eye on Abercrombie and Fitch (ANF). I might make a move on it soon.

Saturday, December 03, 2005

Dream Logging -- Part 2

I guess now is a better time than any to add a few more dreams that I jotted down notes about.

Dream #4

1) Satellite Tourney -- win to move on, but forgot to play anyway

2) Jetpack away with compressed air

3) Migs chasing

4) Crash and burn

Dream #5

1) 115mph cops speeding standing in cars

2) No ticket - lights flashing

3) Geographic landmark natural disaster.

4) Escaped hamsters

5) Water everywhere

Dream # 6

1) Dirty homemade movies in a box

2) Stranded in Lake Tahoe at end of a parade

3) Call Joey for help

4) Arby's -- 2 new ones open their doors

No idea what any of this means really... I vaguely remember them. I tend to forget my dreams as the day goes on. So these notes are the only lasting memories.

Thursday, December 01, 2005

Portfolio and Market Update

Remember Finish Line (FINL)? That dud of a stock pick has managed to make a terrific comeback. Their latest numbers were strong enough to warrant a change in their Q3 earnings guidance from a loss of 1 to 3 cents a share to a gain of 1 to 3 cents a share. My shares are no longer in the red, and it looks like their business is picking up. Now, if only Dryships (DRYS), which is currently my largest percentage loser at -19%, can mount a similar comeback... sigh.

Wednesday, November 30, 2005

Thanksgiving, Theft, and Trading

So, for the holiday weekend, my girlfriend and I made my way down to Riverside to spend Thanksgiving with my parents. The drive there really sucked. You'd think that most people would have already left to wherever they were headed by Thanksgiving day, but you'd be wrong. So, we left San Jose at around 11 in the morning, and we didn't make it to Riverside until it was almost 7. The traffic was pretty bad. I don't remember the traffic being so bad at that time on Thanksgiving day before. Maybe next year I'll plan a bit better if I intend on making the drive again.

I did take advantage of some of the Black Friday sales the day after Thanksgiving... picked up a few DVDs for $3.99 and also The Sims: The Complete Collection at Best Buy (BBY), and also some nice jeans and a decent shirt over at Aeropostale (ARO). Had I gotten out of the house earlier when the stores opened their doors, I could have had a bunch of good stuff. But, I only started my shopping at 7:30.

Saturday, hung out with the Cam Man and also an old friend, Miss Mt. Fuji, that I haven't seen in years over at a bar/nightclub in Brea called 330. Basically danced a little, chatted a little, and drank all night. We finished off the night drinking some Oban 14 Yrs, which is a nice scotch. But, in that price range, I personally prefer the GlenMorangie 15 Yrs.

Before we headed home on Sunday, we dropped by FatBurger for some fat burgers and some of their skinny fries. I really do like the joint. Too bad they haven't really spread out to this area yet. The drive home pretty much sucked too, but not because of traffic, but because we were exhausted and it was late.

And, let me tell you how awesome Monday was. I get in bright and early to find that my notebook computer is missing from my desk. Then, I learn that I wasn't the only one to have my computer stolen. The thieves even stole a nice wooden pen I had on my desk. Those bastards. Anyway, until my replacement computer arrives, I'll be working on a build machine we have stashed away in a mini-cubicle in the corner of our building. I can't even begin to describe how incredibly frustrating this whole ordeal has been.

And finally, I dumped the "gambling" position, Under Armour (UARM), for just around an 11% loss. Will be keeping my eyes open for an entry into a new position. But, right now, I haven't any serious ideas. I'm definitely still looking.

Maybe some Abercrombie and Fitch (ANF) is in order. Just recently, I learned that the fairly new super-duper popular store, Hollister, is owned by them. Maybe I'll finally grab some of the McDonald's (MCD) I've been eyeing for some time now for Chipotle spinoff reasons. Another stock on my radar is New Jersey based Sun Bancorp (SNBC), which has paid an annual 5% dividend via a 105 for 100 stock distribution. Their earnings have been growing, and the stock has been stagnant for a while now. With the Fed's tightening cycle coming to an end soon, maybe some of these smaller banks are worth a look. Or, maybe I'll choose to actually get some rest and worry about putting cash to work at a later time.

Friday, November 18, 2005

What Bird Am I?

Here are a series of clues that lead you to a type of bird. Good luck.

Clue #1: Crimson, Nena's Balloons, Hestor Prynne's "A"

Clue #2: Mr. Toad's Friend minus "R", Sergeant Krupke had one and Porfiry Petrovich probably did too.

Clue #3: What makes a king out of a slave?, Who put the ape in apricot?, What makes the muskrat guard his musk?

And quick update... covered the SYNA for a small profit in the high 24s. The covered portion of EBAY will be called away. Hibernia is no more, as the Capital One (COF) deal is completed. Picked up a little bit of Under Armour as a pure gamble at 25.70.

Wednesday, November 16, 2005

Replacement Burner and Bots

And, what's with the new Movie Bot on AIM?

Here's how my conversation went...

BruteForce: Hello

MovieFone: Hey there. If you cannot remember the title, just enter even a piece of an actor's name and I'll find it if it's playing!

BruteForce: I don't remember anything.

MovieFone: No?

BruteForce: No

MovieFone: I'm sorry then. Why don't you type, help to see how I work.

BruteForce: No thanks.

MovieFone: anytime

BruteForce: You are not helpful.

MovieFone: Mm hm. Such negativity. You are in need of some Tyson protien! Type, help and I will expain how I work.

BruteForce: Tyson Protein?

MovieFone: I think you should type, menu. I was not able to find any movies related to what you typed.

BruteForce: No kidding.

MovieFone: Neat-o.

Talking to a bot is pretty funny for about 2 minutes. Anyway, two more trading days before options expiration. I'm so anxious.

Monday, November 14, 2005

Quick Update

Saturday, November 12, 2005

Aqua

Finally, our time had come. We were seated nearby a giant mirror and had full view of the entire restaurant and all of its patrons. After being presented with menus and a wine list, we were each served lobster bisque and a cracker topped with seafood. We were also given a choice of bread; I opted for the sourdough, and she went for the olive bread. The crust was a bit hard, but the bread itself was quite good.

The waiter arrived and provided us with details of the various dishes available ranging from the texture of the fish to the taste of the sauces. After some perusing, we figured out what we wanted. To start, she had the Chilled Shellfish, which came with clams, prawns, crab, and oysters. True to my sushi loving nature, I ordered the Hamachi. For the main course, I went for the White Sturgeon En Paillotte, and she passed on the fish and decided on the 1 ¾ Pound Maine Lobster “Fricassee” dish. She had a glass of the 2000 Lagrein Blend, Masetto Nero, Endrizzi; I'm not a wine drinker myself, so I had water.

The food was simply amazing, some might even say sui generis. It was some of the best prepared seafood I've ever had in my life. As reference, this meal was a step above those we had at two memorable seafood restaurants, which both happened to be in Las Vegas, Aqua (Michael Mina) at the Bellagio and AquaKnox at the Venetian. The meal was filling, but not so much that we did not have room for dessert.

Their dessert menu was nice, and each dessert had a recommended matched wine to go with it. But, it was late, and we had had enough to drink. So, we just had dessert without the wine. She had the Chocolate Composition, which was a fancy assortment of chocolate confections and fudges along with some ice cream. I indulged in the Oak Spice Crème Brûlée, which was fantastic. Though, to be honest, I preferred some of the chocolate treats in her dessert. After our dessert, they further pampered us with additional pastries before handing us the final bill. The meal cost an arm and maybe two legs, but it was well worth it. I highly recommend Aqua to anyone who is looking for a fancy night out on the town or wanting to dine for a special occasion.

Here are a few pictures of some of our dishes. Enjoy.

Sturgeon

Hamachi

Lobster

Friday, November 11, 2005

First Marblehead Roller Coaster

Quick update...

I am short a bit of Synaptics (SYNA) in the 25.40s. I covered part of it for a minor loss at 26.05. Still holding the rest of the position short. Reasoning is that a lot of current run-up in share prices is due to Apple speculation. If the shares continue to run higher, I will cover for a loss.

EBAY has been smoking lately. The covered shares will likely get called next Friday.

Wednesday, November 09, 2005

Vegas Recap

Anyway, the room we were given was in the dungeon. There was no straight path to our room. In order to get to it, we needed to take an elevator or escalator up a floor then walk a ways to another set of internal elevators, which then had to be taken down a floor. It was an awkward path. Lucky for us on this trip, none of us needed to invoke our drunk card.

All of us were itching to play some live poker, so off to the Bellagio we went. Man, let me tell you how much the Bellagio poker room sucks nowadays. It is extremely cramped; it seemed like that added quite a few more tables since the last time I was there. The cocktail waitresses weren't able to move around at all. This led to slow service that then led to grumpy players. And, grumpy players that are losing money aren't all that much to play with. The Bellagio game was really soft. PetDander and I played some 8/16 there and Alex hit the 4/8. The highlight for me was hitting quad Jacks against a guy's boat (sixes full). We all cashed in our chips shortly after the Marquis showed up. I take that back... Alex got pounded on this first session, so there was no cashing in for him. But, don't worry, there's a happy ending for him.

Next, we ate at an extremely overpriced (due to portion size and not actual prices) restaurant in the Bellagio before we headed off to Mandalay Bay. The plan for Mandalay Bay was to meet up and drink a bit with an ex- from years ago. We all met up at the Island Lounge smack in the middle of the hotel. The meeting wasn't awkward at all, and the drinks were flowing. She even gave me a couple of poker books that her company had gotten for free.

Now, that was a bit awkward. Carrying around poker books in plain view while walking around a casino is tantamount to wearing an "I am a Tool" T-Shirt. We also managed to hit up the Raffles Cafe to eat our real dinner since we were all pretty hungry. After the meal, we all said our good-byes to her, and we were off to start our drunken low-limit poker session.

The Mandalay poker room is a nice small room. We played in a low-limit 4/8 game with 1/2 mini-blinds. It was a ton of fun. Playing like a fish every now and then at the lowest limits can be a lot of fun, and it doesn't cost you too much in terms of long-run expectation. After splashing around for many hours, PetDander and I dropped a little bit, and Alex escaped breakeven. We finally crashed in our hotel room at 9 in the morning.

That's the end of my happy poker stories. The next one is sad. On Saturday, we met up with old friends, Jimmy Schlong and Dr. Madav, on the strip while walking to the Wynn. They happened to be in Vegas that same weekend, and so we planned on meeting up briefly with them. So there we were on our way to the Wynn... off to play some 15/30. We got there and were seated relatively quickly. And within 4 hours, I dropped a good number of bets. A good 25% of the loss was due to my donkish play after being outflopped and outdrawn constantly. I really should have had more control of my emotions, but it was too late, and the tilt monster showed its face. PetDander played well, but still took a small beating. Alex won a bit in his 4/8 game.

There was no more poker for me the rest of the trip. I took my beating and then played a few pit games before calling it a night. PetDander and Alex played in the 6/12 at the Mirage though. I was not there to witness Alex's run, but he ended up a substantial winner.

While not a profitable weekend, it was fun. All I need now is for EBAY to move so I can wipe out the weekend's expenses. There will be a next time. Time to head back to bed for a quick nap before work.

Friday, November 04, 2005

Quick Update

Thursday, November 03, 2005

A Mixed Bag

Enough of the bad news. The first bit of good news I received today was that Harrah's (HET) had a strong quarter showing all the naysayers that its earnings were nothing like those of MGM-Mirage (MGM). Then, after the market closed, Expedia (EXPE) reported its earnings, which were spectacular. It had already risen quite a bit, most likely due to the strong Priceline (PCLN) earnings report the day before. But, after its own earnings report, it moved an additional 15%. Also, EBAY made a strong move, which really helped out. I am going to be selling some November 42.50 calls to cover part of my position if I can get a good price on them.

Today's mixed bag really is a testament to why diversification is desirable. If your portfolio were concentrated in a single stock such as FMD, then today would have spelled disaster. You would be in a pit so deep that a quick recovery would be nearly impossible. But, when no single stock makes up an enormous percentage of your entire portfolio, you can absorb these spikes. While such spikes are plenty painful, they are not lethal.

I'm off to Vegas this weekend with PetDander and Alex. Hope to make some cash and have some fun too.

Sunday, October 30, 2005

Halloween Party

Met a lot of fun people and had a blast. Had to take cab home last night because we all had a bit too much fun. Anyway, here are a couple of pictures of our costumes.

Saturday, October 29, 2005

Trick or Treat

Anyway, here's a treat for you... a Quiznos coupon that gives you a free upgrade to a combo meal if you buy a regular sub. A pretty good coupon, really. And, I just got back from there so it's valid. You'll probably want to click on the image to get a full-sized one before you print it out.

Wednesday, October 26, 2005

Harrah's: Worthwhile Gamble?

Used the proceeds to add to my long-term Harrah's (HET) position. Harrah's has been hit hard recently (along with the entire gaming sector) due to the negative effects of the recent hurricanes.

Today, MGM Mirage (MGM) announced earnings that were clearly below what the Street had been expecting. Of course, much of the blame can be placed on the hurricanes. Nevertheless, the stock was pounded on and lost nearly 14% of its value today.

Other gaming stocks fell in sympathy. Among them was Harrah's. The MGM numbers weren't good, but there was still reasonably strong growth once the one-time effects were removed. So, Harrah's traded down a bit today and I snagged some at 59.45. Currently it is trading in the high 58's. But, the big day is November 3. On that day, Harrah's will be announcing their earnings. My view is that if they meet expectations the stock should move higher since the current sentiment is so negative. If the don't, then the stock might move lower, but not by too much since a lot of anticipated bad news has already been priced in. Let's not sweat the short-term moves too much. Long-term, I think the company is a winner.

Sunday, October 23, 2005

Dream Logging

Anyway, here are the notes for the first three dreams that I jotted notes about.

These are notes really came from a half-sleeping state. Even I don't know exactly what the dream was about. Just use your imagination.

Dream #1

1) Pick items -- 3 on the pedestal.

2) Make a large mess -- the final event.

3) Nevermind, but not enough.

4) Must have shoes -- a rule.

5) 90% will pass

Dream #2

1) Matching clothes -- a game

2) Family - Uncle and cousins

3) $600 in chips

4) Winner collects cards

5) Win all = 5x prize

6) If lose, then $5 only

Dream #3

1) Heated Poker Tracker argument

2) Self-assessment only

3) Moving large trees in wooded area

4) Friends driving to Denver

I might continue to do this, because it's really kind of trippy. I have read in the past that jotting down notes on dreams actually helps you remember your dreams going forward. Might be worthwhile.

The Big Week in Review

Amgen (AMGN) - Slumps a bit due to their sales number. Earnings were fine and grew nicely, but their top line growth apparently wasn't good enough. It's had a nice run recently, and as a long-term holding, it should do fine.

Eastman Kodak (EK) - Fairly dissappointing. Due to charges, the company lost $1B. There is a strong possibility I will be selling this one by year-end to take the tax loss. If I choose to do so, I might still buy it back sometime later, but would be forced to wait the mandatory 30 days.

North Fork Bancorp (NFB) - Their profits doubled, but they missed their earnings target. Shares didn't do too much following the announcement.

Hibernia (HIB) - Posted a major loss due to charges resulting from the hurricanes. Stock moves with Capital One Financial (COF), who is acquiring them. The deal should close some time in late November.

Juniper Networks (JNPR) - This is a recent addition to the long-term family. It posted strong earnings and revenues. Its profits jumped over 70% on more than 45% sales growth.

Linear Technology (LLTC) - Posted a slight decline in profit. They cited increased R&D costs. However, this beat the street's views, and the shares traded higher following their announcement.

Altria Group (MO) - Earnings were mixed. Tobacco was strong, but Kraft was a real stinker. But, with the recent Supreme Court ruling in their favor, we should hopefully see a break-up of the company. When that happens, I might exit out of the Kraft component and channel those funds into the tobacco components. Cheese doesn't quite have that addiction power.

St. Jude's Medical (STJ) - Mentioned earlier, they made a major purchase and posted solid earnings.

Student Loan Corp (STU) - Shares moved a little lower following their earnings, which gave a mixed picture on their current business.

Now to the two positions that were awaiting expiration Friday...

eBay (EBAY) - Earnings were strong, but their outlook was weaker than the Street had hoped. Shares came down from $42 to $39s. This means that none of my shares will get called away. I will now need to figure out what I want to do. The situation at this moment is the shares have a cost basis of $37.58. I can sell another round of options as I did the first time (two-thirds covered, one-third left to ride). Or, perhaps I can wait for a spot to just dump the position, hopefully in the $40-42 range.

Seagate Technology (STX) - Mixed earnings picture, a Bear Stearns downgrade, and a CSFB reduction in earnings estimates caused shares to come down from mid-$15s to about $14.25. So, at this point we're nearly break-even on the buy-write. Just a tad underwater. Despite Seagate being the leader in their space, I will probably exit the position next week or so.

And, there you have it... the week in review.

Monday, October 17, 2005

Start of a Big Week

Anyway, this is a big week for me. We start off with St. Jude's Medical (STJ) announcing the $1.3B purchase of Advanced Neuromodulation (ANSI) and also reporting great earnings. The Supreme Court rejected a Dept. of Justice appeal in the RICO case. On Wednesday, Altria (MO) will report its quarterly earnings before the market opens, and EBAY will do so after the close. And, we'll close out the week with the expiration of the EBAY options and Seagate (STX) options.

Saturday, October 15, 2005

Windows Notepad Issue

Try this:

1) Open up Notepad.

2) Enter the following text, but do not insert an endline: x = 5000

3) Save the file, but be sure to choose ANSI format.

4) Close Notepad.

Now, try opening up the file in Notepad. Notice that the text is screwed up. Use any other text editor, like Wordpad, Word, UltraEdit, etc. And, you'll see it works fine.

Lame. Here's a link to a text file that was created as I described in the instructions above (for those who can't get it working): Download Here using a "save link as..."

Thursday, October 13, 2005

Umpire Blows It

Tuesday, October 11, 2005

Secrets Revealed!

Anyway, I've created a user-friendly image decoder that is now available for download. This one can be downloaded here: Link to Decoder. Unfortunately, this is only for those using Windows.

Usage:

0) WARNING: If you click on the Decode button when the Base Image and Output Image fields are invalid, the program will crash. I have not put in any error handling in the code.

1) Browse for the .bmp files you downloaded (from here) as the Base image. For example, OceanScene.bmp.

2) Do a Save As and set an output .bmp file.

3) Click on the Decode button, and the output file is created.

4) Have a look at the unlocked secret image.

With more work, I should be able to get way better than 25 to 1 ratio, and also allow the embedding of generic files. Think about hiding an Excel or Word document in an image. The idea is that without knowledge beforehand that some secret data was embedded in the image, no one would even suspect anything was there. This would allow the data to be not only protected, but truly secret. At some point, I would also like to add a feature allowing you to further scramble the data using a password.

There are a lot of ideas to make this useful and better... just wanted all of you to have a first glimpse. The current encoding is rather unsophisticated, but as I mentioned, the beauty is that no one would really even look for any hidden data since it's a fairly standard picture.

The encoder is not ready for general use. I won't be distributing that until I feel it's ready. So for now, enjoy the decoder.

Would love to hear any and all comments.

Update: Two people have now told me that there's a word for what this is... steganography.

Saturday, October 08, 2005

Secrets

Ocean Scenery: http://download.filefront.com/4227811

Dog: http://download.filefront.com/4227808

More explanation later.

Wednesday, October 05, 2005

Traffic Jams

I think that too many people scoff at what seems like a drastic measure, but it really does make a lot of sense. Painful as it might be initially, the longer term effects of having a more appropriately priced traffic system in place might be quite good for the nation as a whole. One beneficial side-effect would be that a number of us would be forced to be more social. I'd much rather live in a society made up of more sociable people than not.

For those who think that increasing the cost of utilizing public roads would hurt the lower class... perhaps this could be offset by making public transportation free by having drivers subsidize the costs. I am sure there are many ways to make the system a bit more fair. Surely, many would hate what they perceive as a less convenient system, but it really would be a personal choice. You want convenience? Pay for it. If you don't want to pay for it, then don't complain.

What do you think?

Monday, October 03, 2005

Poker Weekend

Anyway, we hit Bay101 for two lengthy sessions of $6/12 hold'em, one for 8 hours and another for nearly 22 hours. After these two sessions of poker, I am spent and exhausted, even after sleeping for about 12 hours.

This weekend happened to be one of the best weekends to play because it is one of those special weekends that the alignment of paydays is achieved. This syzygy of monthly, semi-monthly, and bi-weekly paydays is a wonderful thing in the world of poker. It means tons of people have a lot of cash available, which they are more than happy to give away. To give you an idea of how many people were waiting in line to part with their money, let me say that Alex and I waited almost 3 hours to get a seat at a table on Friday night. Saturday night we only waited half as long, because many would-be players no longer had as much money at their disposal.

Here are some poker highlights from this weekend:

- 74 suited takes down a pot unimproved vs 23 offsuit. With betting and calling all the way to the river.

- One very special fish managed to get very lucky and win about 50 bets in an hour, only to give it all back plus another 150 bets in the next six hours rebuying into the game about 10 times. At least he had a ton of fun, as he was joking and smiling the whole time while giving up his money.

- Alex's 77 flopped quads and got paid off handsomely when a guy hits aces full on the river.

- After already having accumulated a mountain of chips, I added to the growing pile with a Royal Flush made on the river with KQ suited on an AJx flop with two of my suit.

- A man who really wanted to bust Alex and hurt him allowed a flop to get checked through with his top pair and top kicker, allowing me to spike a set and piss him off in a major way.

- On the turn, a very tight prop player announces to me that he has AA and allows me to look at one of his two cards after we both put in a lot of chips pre-flop and on the flop. At the turn, the board is Ten high, and I am sitting on QQ. I take a peek and see the Ace of spades. I lay my hand down. If he had AK, and thought that either card would scare me, then he made a wonderful move. But, I guess I will never know.

- A player has 64 suited in the blind. He is raised and calls. He sees a flop of Q64. He goes to war with another player when the turn is a 4. The players end up going all-in, and when the hands are turned over, we see that the other guy has QQ. The man with 64 says, great hand and congratulates him sincerely and is all about ready to push the chips his way when the miracle 4 hits the river. What a spectacle!

- After a guy folds and asks what he has, Alex tells a guy, "Pay me $2, and I'll show you my cards." The guy says, here you go, and shows him the bird.

All in all, it was an extremely fun weekend, but extremely draining, both physically and mentally.

Wednesday, September 28, 2005

On My Head

I don't think there was any way I could have seen this particular matter coming. Bah, again.

Monday, September 26, 2005

Exit Viagra, Enter the Gorilla

With the sale, I used the free cash to pick up one of the stocks I recently added to my watch list... Kongzhong (KONG). First mentioned here. Anyway, I picked up KONG at 12.90. KONG provides wireless interactive services in China. And, my hope is that the new position will perform well enough to remain in my long-term portfolio.

Friday, September 23, 2005

Trade Update

In the last two days Goldman has been saying some good things about EBAY, which has really sparked a move. Just minutes ago, I sold the Oct 40's for $1.30, covering two-thirds of my EBAY trading position. This brings my cost basis down to $37.58, but it also caps potential gains past $40 on the covered position. At least if EBAY moves significantly higher in the coming weeks, I'll be able to capture that move on a third of my current position.

Wednesday, September 21, 2005

Blood on the Street

So, McDonald's has announced its intention to spin-off Chipotle. If none of you have given it a try yet, do so. It's pretty damn good. My personal favorite is the Carnitas Burrito with the red hot sauce and salsa.

Trading Update

EBAY is hurting me a bit. Still have a position averaged at 38.45.

RF Micro Devices (RFMD) - Sold off the last 20% at 6.45 before the recent tumble. At this point I have no position in this stock.

Seagate Technology (STX) - Did a buy-write on this one. Bought at 15.07, and sold the October 15's for 0.70. The goal is to get called away at 15 upon expiration. This would yield close to 4 1/2% for 5 weeks if all goes according to plan. Break-even on this trade would be STX at 14.37.

Sunday, September 18, 2005

Combinatorial Diversion

The image below shows two television programs, Red and Blue. We will assume that the starting/ending points of television programs cannot be shared. If that is the case, we have 6 ways to organize the programs relative to each other. We have the first case where Red begins and ends completely before Blue begins and ends. Another case is where Red begins, Blue begins during Red, Red ends during Blue, and Blue ends after Red is over. Yet another case is where Blue begins and ends completely within Red's scheduled block. We have another three relative configurations when we look at the other case where Red and Blue are reversed.

So, the number of relative combinations for 1 television program and 2 television programs are f( 1 ) = 1 and f( 2 ) = 6. In general, what is f( N )?

Here are six different relative combinations for N = 3, just to help get the combinatorial juices flowing. Because I received some questions about the following combinations... let me state that the following is NOT complete for N = 3. There are way more than 6 relative combinations if you have 3 television programs.

When I initially solved this problem, I did so in a rather inefficient manner. I ended up with a recurrence relation. However, the closed form answer is very clean and makes a lot of sense. Give it a try.

Saturday, September 17, 2005

Trading With The Enemy

If you liked Liar's Poker or Monkey Business, you might find some enjoyment out of the book. At the very least, it's an incredibly fast read, so if you end up hating it, you would not have wasted much time.

Bottom Line is... there's greed and megalomania, and then there's Cramer.

Friday, September 16, 2005

Simple Things

1) Motorized UltraSorter

2) Staples One-Touch Stapler

3) Beyond Compare

4) Auto-dimming rear view mirror

5) Sportsman Swiss Army Knife

Thursday, September 15, 2005

Hints for What Am I?

Picture B: 6 letters, starts with C, often salted

Picture C: 6 letters, 3 letters twice (i.e. format: ABCABC)

Picture D: Brazilian, lots of caffeine so it packs a punch

Wednesday, September 14, 2005

What Am I?

Click on pictures to zoom!

Picture A

Picture B

Picture C

Picture D

Tuesday, September 13, 2005

Portfolio Update

Monday, September 12, 2005

Quick Update - EBAY

EBAY - Skype Deal

Here are a couple of excerpts from FT (full story here):

"EBay was in the final stages late Sunday of sealing an agreement to buy Skype, the fast-growing provider of voice calls over the internet, for more than $2.6bn, according to a person close to the situation."

"Under the terms of the potential deal, Ebay is understood to be preparing to pay $1.3bn, in cash, along with another $1.3bn worth of stock. It would also pay $1.5bn in performance-related benefits as part of an earn-out that would keep Skype's managers at the company until 2008."

Sunday, September 11, 2005

Hodgepodge

Looking into McDonald's (MCD) for long-term purchase.

Now that stock talk has been taken care of... so, last night I finally sat in a $30/60 poker game online. It was very very aggressive, but I did okay. I did fine not because of my superior play, but because of what seemed like completely donk play. Here's a hand from last night: Click To View Hand. Honestly, you would think that this type of play wouldn't really be seen, but you'd be wrong.

The NFL season is in full swing now. I'm in this NFL Pick'em game with a few friends. The two people in our game who know the least about football are basically winning. It's pretty funny... up to this point, here are the scores:

Crestfallen 81

Marquis 71

Brute Force 65

JDot 61

GZA 56

Finally, here's a congratulations to JDot for winning a $50 tournament, winning a seat in a $1050 buy-in tournament, and following through with an in-the-money finish. Talk about a score.

Friday, September 09, 2005

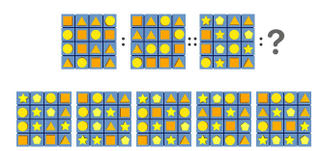

Logic Pattern Puzzles

Puzzle 1

Puzzle 2

Puzzle 3

Puzzle 4

Wednesday, September 07, 2005

The Weekend and a General Update

Over the holiday weekend, we headed down to SoCal. Our first stop was Marina Del Rey, where we crashed for a night in a 3-bedroom corner apartment at the Azzurra. Talk about lavish urban living. Though we arrived late (close to midnight), we still managed to have a few drinks with my friend, the Cam Man, and another old high school buddy of mine, Alex. And, I also got to meet Cam Man's new girlfriend and Alex's new wife.

The next day, we hit up Sushi of Naples in Long Beach. The sushi there was okay, and nothing special. But, it was far from great. We were really hoping to go to Kotobuki, where Hiro, the best sushi guy ever, would have whipped up some tasty pieces. Unfortunately, Kotobuki is closed for lunch on weekends. After a quick lunch, we headed out to where I used to live in Laguna Beach, and walked along the ocean admiring the beautiful scenery (and bodies). Next was a quick stop at the Irvine Spectrum just to see how much it had changed... and it has, a lot. Of all the stores that I would have expected to be around still, I did not expect Houdini's Magic Shop to be one of them.

Finally, we made it to Huntington Beach where the GZA and his lovely wife reside. We would be staying here for the rest of the weekend. The first night, we caught an Angels game with the Barber, and watched helplessly as their relievers were ripped to shreds. The nachos were damn good, and the jalapenos were pretty hot. After the game, the GZA was a bit bummed out by the loss, and so we all had to drink with him to ease the pain. But, it was a good thing, as we would be preparing for tomorrow's BBQ and drinkfest.

Sunday came, and the place had a fresh new infusion of guests: Grambrero and his brother, Shaolin Vin, and of course, the Barber. Grambrero brought with him a portable breathalyzer, which added a ton of fun to this party. It's pretty amazing how much high a BAC you can have and still be conscious. At one of his drunkest moments, Grambrero registered a solid 0.31. Now that's impressive. But what was even more impressive were the hamburgers that the GZA and his wife prepared with onions and spices. They were simply amazing. If the two of them ever decided to quit their jobs... err, if *she* ever decided to quit her job and start a burger joint, they'd do quite well.

After saying our good-byes on Monday, we had a late lunch at Mi Piace in Old Town Pasadena. The food there was excellent. I had the Linguine con Capesante, and she had the Calamari e Gamberi Fra' Diavolo. What's even better were the prices, which were quite reasonable for that quality of food. The only downer was the service was slow, since they were understaffed for this Labor Day holiday.

Now, onto some stock talk...

Hibernia (HIB) was hit hard by Katrina, which caused a delay in closing the deal with capital One (COF). This led to an eventual 9% cut in the terms of the deal. So, that stings slightly, but it could have been worse, I suppose.

Synaptics (SYNA) hit the low-end of my price target ($18) today. And, I dumped my shares at 18.05. But, this was only half of my original position. I believe I failed to mention that I had dumped the other half in the 16.70s... just around the time I mentioned my increased nervousness with respect to the market. And, now I see it peaked in the mid-19s, but came back down a bit.

New on the radar: First Marblehead (FMD).

Been playing some EBAY today long and short, just for fun. But, nothing really worth going into detail about. That's all for now.

Tuesday, August 30, 2005

Look At It From A Different Angle

Say we have two points each with a tail angle from 0º to 360º. For example, let's say we have Point A with a tail angle = 5º and Point B with a tail angle = 25º. The average angle is 15º. Likewise, if we had Point A with angle 10º and Point B with angle 280º, then the average angle would be 325º. We want the average angle to be taken from within the more acute angle formed by the two tails. Simple. No issues at all.

What if we had N angles? For example, N = 3, and we have the following angles: 88º, 268º, and 2º. Then, the average angle would be 359 1/3º. Now, what if we want not only the average angle, but also some measure of coherence. Let me clarify this a bit. If all N angles were in a tight range from 0º to 10º, then the coherence would be very high. If the N angles were scattered fairly uniformly from 0º to 250º, then the coherence would be quite low. So, the question is... what's a good way to go about obtaining an average angle and a coherence value given N angles?

There are many ways to go about this. At work, we came up with numerous ideas and methods. Some methods were rather novel, but unfortunately were inefficient. Others were straightforward and efficient, but produced faulty results. The method we ultimately settled on worked well for our needs, but I'll keep that method hidden... for now.

One final note... for now, pathological cases can be ignored. An example of a pathological case would be where N = 4, and the four angles were 0º, 180º, 5º, and 185º. In this case, the average angle could conceivably be either of two possibilities. Have fun with the problem.

Finish Him... Fatality!

I can't blame Katrina and the Waves for the dismal Finish Line (FINL) earnings and guidance released this morning. FINL got crushed and I'm thoroughly dissappointed. The market has turned south, which makes sense now that the hurricane damage can really be seen by everyone. There ain't no sunshine to be walked upon, instead we have a fatality.

Monday, August 29, 2005

Quick Update

Sunday, August 28, 2005

The Weekend

Saturday was completely set aside for recovery. Except for the occasional meal, we slept. We did manage to have a midnight snack at a restaurant specializing in Shanghai cuisine. That was certainly enjoyable.

This brings me to a horrible meal I had tonight. We were going to try a new sushi bar in Mountain View, but unfortunately, we learned that it was closed on Sundays. So, we drove around and decided to try a place we drove past in the vicinity called Ariake Sushi. This place was absolutely horrible. Simply put, the sushi was not fresh and the temperature inside was nearly unbearable since they did not have any air conditioning. The best part of the meal was that we decided smartly to do a small test order first. So, we ended up ordering about one third of our usual order before we decided to pay the bill and leave. Absolutely horrible.

And, well, I'm no longer on poker break. Been running better. Hope it continues. Currently clearing a fresh new bonus on Paradise Poker. That's all for now.

Friday, August 26, 2005

Sentence Redundancy

Last year, I went to Australia 14 times.

I went more than once a month.

Clearly, the second sentence contains redundant information. The question I have is, had he said the two lines in the opposite order, would this be more acceptable and no longer considered redundant? I found it interesting that order might play a role in qualifying the nature of sentences.

Thursday, August 25, 2005

Supply, Demand, and the Slippery Slope

Say we have some good selling for $N, and that N is large. Then, tiny changes to the selling price should not affect the quantity demanded. By using the slippery slope argument, all selling prices would yield the same demanded quantity. Even though we know that the slippery slope is a common fallacy, I think it's interesting to discuss a slightly more complex supply and demand model that would accomodate the slippery slope argument, yet not fall into its trap.

If instead of hard and fast supply and demand curves, what if we had blurred curves that represented the probability that quantities would be supplied or demanded at various price levels. Say that you would certainly buy a particular car if it costs $25,000. Now, let's apply the slippery slope to this example. So, we find that at $25,000.01 you're obviously still a buyer. However, for every price movement, the probability that you'd still buy it, at that very instant in time, would change. Even the tiniest changes in price would result in the tiniest change in this probability. For example, at price $0, there would be a 100% chance that a rational person would buy. But, even at $0.01, the probability would no longer be 100%.

Let's not forget that the actual curves would account for all the population and produce an aggregate distribution (the blurred lines). So, now the slippery slope would fail (I think), because at any given point you are merely given a probability that certain quantities would be demanded.

Anyway, I think that adding a simple probability component into the simplest supply and demand model provides a better view of reality. Maybe this is all obvious, maybe it's ridiculous, or maybe it's quite wrong. But, I do know that this topic is what kept me occupied during the string of uneventful meetings I had today.

Tuesday, August 23, 2005

Do The Market Hokey-Pokey

You take your right foot out.

You put your right foot in...

And you shake it all about.

So, after the Intel Developer's Conference produced nothing but a ho-hum, I exited the Intel (INTC) in the 25.80s for a tiny profit. I swapped back into EBAY at the close of the day at $39 on the nose. I figured I'd go ahead and take the discount that it's giving me.

In other news, Harrah's (HET) announced last night that it bought the Imperial Palace for $370MM. I'm a bit surprised that they made their purchase so soon after their mega-acquisition of Caesar's. But, this is a tiny purchase for a monster like Harrah's, so maybe it's not such a big deal.

Sunday, August 21, 2005

The Weekend

Last night, I went to play some poker at Bay101 with couple of other Norwegians (looks like I'm on a Norwegian kick right now, since they all leave in a week and they've all been wonderful people). As we all know, I am on a self-imposed poker break due to a nasty slide earlier in the week. So, I chose to play some low limit poker. And, my slide continues. At least it wasn't too bad a loss, not even 12 bets. That's poker.

One thing that's really lame about the City of San Jose is their active involvement in making life hard for card rooms. For example, the tables at Bay101 are nice, and they area all equipped with auto-shufflers, which help speed up the games. However, every so often there is a jam and a red light goes off. The dealer is not allowed to fix the jam by law; it is illegal for them to do so, and so a floorman must be called over to rectify the problem. How ridiculous is that? Seriously. Despite this kind of stupidity, live poker is still a blast. I am thinking that I should play more live and less online, even if online is much more lucrative.

Quick Trading Update

Thursday, August 18, 2005

80's Theme Song Fun

Theme Song #1

Theme Song #2

Theme Song #3

Theme Song #4

Theme Song #5

It's A Mystery

So, after seeing this, it occurred to me that mystery can have a positive, neutral, or negative connotation, depending on the context. Mystery meat is clearly negative. When used in most contexts, the word is neutral. And, the word can even have a slightly positive connotation such as in the phrase, man of mystery.

I haven't thought about this much at all, but what other words can be positive, neutral, or negative? It doesn't seem that words that possess this trait are all that common.

Wednesday, August 17, 2005

Break Time and Vegas

Tonight, I watched a re-broadcast of a CNBC special, On Assignment: Las Vegas, Inc. It was pretty good actually, and I enjoyed it. The program highlighted three different casino powerhouses and their different approaches to the gaming business. This was really quite interesting and informative.

The first person shown in the program was Steve Wynn who recently opened up the Wynn. In his interview, he really showed his gift. The man is absolutely amazing when it comes to the psychology of style and design. He did a great job talking about all the little things that are considered when a casino is designed.

The next guy interviewed was Harrah's CEO, Gary Loveman. He used to teach classes at Harvard Business School, and one day he decides to give 'real' business a try. His approach to the gaming business relies heavily on datamining technology, which gives him an edge when it comes to assigning values to people. Like a great stockpicker, he is able to find value where others were not looking. He then invests in these undervalued people by offering them comps and deals.

Finally, they talked to one of the Maloof brothers who operate The Pams Casino. They target the younger crowd using sex. Because, well... sex sells; it always has and always will. They talked about their media-based marketing strategy including their MTV's Real World connection, Celebrity Poker Showdown, and their recent licensing agreement with Playboy.

One final fact of interest was that slot machines produced lower percentage returns in terms of dollars wagered compared to various table games at the casinos. This means that people must play horribly at the table games, or the figures include the additional comps made to slot players that aren't given to table game players. The show quoted a whopping 12% edge in blackjack and only a 6% edge in slots. But, slots still provide a better return on investment, since they cost nearly nothing to operate.

All in all, it was a neat special on Vegas. It was nothing like the boring Vegas shows that can be seen on the Travel Channel.

Monday, August 15, 2005

Weathering the Market's Storms

On the bright side, EBAY is holding its own above the $40 mark, and Synaptics (SYNA) has moved to a new closing high since its crash. Still looking for $18-20 on it. The current plan is to unload half at 18, and decide what to do with the other half based on how it trades in that range. Their VP recently picked up a quarter million dollars worth of it at $15.29 (yes, he got a better price than me, damnit!). It is usually a positive sign when an insider places a decent sized bet. Insider buying is much more useful than insider selling. There are a ton of reasons why an insider would sell stock... diversification being the main reason, but buying usually means the company is worth more. We'll see how it all turns out soon.

Just to come full circle... Today, I came across an old paper from 2001 (download here) that examines the relationship between weather and stock market returns. Not the most interesting paper, but I think their findings provide strong evidence that the market is far from efficient.

Friday, August 12, 2005

The Ultimate in Advertising

Thursday, August 11, 2005

If McDonald's Were Run Like A Bar

Anyway, I was thinking about how different everything would be if fast food chains adopted a policy that is in effect at bars today. What if an obviously obese person were to walk up and order a Super-Sized value meal at McDonald's, and the cashier said, "Sorry, you're cut off. You're too fat, and we're not going to promote this self-destructive behavior. But, we can let you have a chicken salad and some lite dressing." Surely, restaurant revenues would decrease by quite a bit. But, what if the government subsidized the loss of revenues, since they would certainly save a fortune in health care costs further down the line.

I know that this would never happen, but I think it's interesting to think about. Also, while the obese of the world might find this practice discriminatory, I don't see how it's all that different from cutting someone off the alcohol at the bar. This of course assumes that the person in question was not going to drive, which could potentially lead to injuring another individual.

Interested to hear your thoughts on this. It's radical, but I am willing to bet that it's effective. I do not believe that we would have widespread obesity if it wasn't so easy to get a hold of really fatty foods.

Tuesday, August 09, 2005

A Couple Tahoe Pics

The Axe

Saturday, August 06, 2005

Tahoe and Life

How enjoyable is life? When you read a really good book, you can read it over again. When you've watched a great movie, you can watch it repeatedly. When you play a fun game or video game, or maybe even complete it, you can play it again and again.

Now, say that you've done extremely well in life... you built an empire up from nothing. Think of those like Bill Gates, Oprah Winfrey, or even Snoop Dogg. If they could, do you think they'd allow some magical djinni to zap them back to being a total nobody, and try life again? It's obvious that they "beat" the game already, and they are all still fairly young... but, was life enjoyable enough and fun enough that they'd want to try it another time, which certainly would result in a new outcome? Or, is life itself not really enjoyable and fun. And, this is why you strive to get to the top, so you simply don't have to deal with "life" in the same way as the masses?

Thursday, August 04, 2005

A Real World Efficiency Problem

We have 25 participants who need to go through a data collection process. The data is being collected under 6 different environmental settings. The environments are being created for us, since the data collection is taking place inside a large temperature / humidity chamber. In this chamber, there are 3 data collection stations: A, B, and C. Data collection on Stations A and B takes approximately 4 minutes of time on each. Data collection on Station C takes approximately 2 minutes of time. Some of the environments are harsh, meaning that prolonged exposure could cause some serious discomfort. Assume that a person feeling serious discomfort cannot work as quickly to complete data collection. Each participant needs to have their data collected on all three stations at all 6 environmental settings. When this occurs, the data collection project is deemed complete.

Some people will take longer than others, sometimes twice as long, on certain stations. However, we do not know how fast each person will be a priori. Only when all the data collection has been completed at a given environmental setting will the chamber be re-configured to simulate a new environment. Adjusting the environment takes approximately 15 minutes of time.

Now that I've furnished you with the background information... I'll propose two different ways to handle this data collection process, as well as provide pros and cons of both. I'd like to hear what you think, and what other adjustments could be made with the end goal being the total time it took to complete all the necessary data collection.

Path 1: Line up stations in order as Station C, B, then A. Form a line outside of the chamber. The Person #1 goes to Station C. When he completes it, he moves onto Station B, and Person #2 goes to Station C. As soon as each person has finished at a station, he will move to the next spot as soon as it becomes available. So, we basically form a queue and move everyone serially through the three stations. We repeat this for each environmental setting.

Pros: Very organized method -- should be a single pass and we're done. Also, less overhead due to participants not knowing exactly which station they should go to, or if they've already finished on one.

Cons: Less efficient use of each station if there is a slow person causing a bottleneck. Could increase the average time of exposure to each environment, causing additional slowdown.

Path 2: A line will form outside of the chamber, just like in Path 1. However, Persons #1, #2, and #3 will enter the chamber. The first one that completes the data collection at his station will wait until a new station opens itself up. He will immediately fill any open station with which he has not yet collected data. Only after a person has collected data on all three stations in the chamber will he leave the chamber to allow another person inside. At all times three people at most will be inside the chamber.

Pros: Seems to keep station utilization at near 100%.

Cons: An organizational nightmare. Could force us to re-collect data when participants miss a station or collect data on the same station twice. Bottlenecks will still cause similar problems as Path 1, but to a lesser extent.

Which of the above paths do you think would be the better one? In Path 1, does the ordering of Stations A, B, and C matter? Practically speaking, is there that much time to be saved by taking Path 2... data re-collection can be quite time consuming. What if we ignored potential data re-collection time... how much time are we likely to save by forgoing organization? What other factors should be considered?

Wednesday, August 03, 2005

Quick Earnings Play

Tuesday, August 02, 2005

Quizno's Combinatorics, Spam, and the BDI

Using the above assumptions for what is offered, I calculated: 30*10*10 + 30*10*6 + 30*10*2 = 5400 combinations. I know that I could be off on my estimates of how many different types of subs, chips, etc. are offered, but I don't think I'm that far off. Maybe they are factoring in different types of breads for their subs. I suppose that additional difference would get us over 18,000 combinations, but that sure seems like cheating. Anyway, onto Spam.

Spam... No, not that kind. I'm talking about Hormel Foods (HRL), the makers of Spam, the meat product. From what I've read recently, many are forecasting a decrease in hog prices. According to CSFB, if this decrease materializes Hormel could see a boost to their earnings by as much as 5%. This is one of the big reasons why they were recently upgraded by them. Hormel also sports a nice 2% dividend, and their operating cash flow continues to be fairly strong. I'm adding this to my watch list as a potential long-term position. And, just to be absolutely clear on Hormel... Spam is not a major source of revenues for them. I believe Spam accounts for 2% or less.

Today, Dryships (DRYS) reported its earnings. By now, you've all heard about my DRYS woes. I added it to my long-term portfolio recently, and it's down a decent amount. Why? Shipping rates have plummeted, as can be seen by taking a look at the Baltic Dry Index, or BDI. This isn't a widely known index, but for shippers, it is the index. The BDI is a weighted index that includes shipping rates for the three major classes of dry cargo ships: Handy (smaller), Panamax (medium), and Capesize (large). Anyway, the BDI dropped sharply in recent weeks, and the market punished the shippers. Despite this drop in the BDI, DRYS earnings this quarter were spectacular. This should hopefully stop the bleeding. In time, the BDI should recover, and when it does, DRYS (and other shippers, too) should be worth a good deal more than the current market valuation.

Monday, August 01, 2005

Current State of Market Internals

I found it to be an interesting read. Maybe it is time to re-evaluate the market's condition. Perhaps this divergence between the Russell 2K and the other major indices can be played as a pairs trade using index ETFs. Or, maybe this is just another doomsayer trying to rain on the bull's parade. Looking at other writings of his, it does not seem like it, but anyone can be deceived.

Sunday, July 31, 2005

Poker, Investing, and Specialized Brain Damage

The study basically involved normal people and two types of brain-damaged people, those whose brains were incapable of feeling fear and anxiety and those whose brains were able to harbor such feelings. All the participants were given many betting opportunities which were quite obviously in the participants' favor. All those who could feel fear would often base their future investments on previous outcomes, while those with the specialized brain damage would invest fairly regularly throughout the study. Because the investments had a positive expectation, over the long run, those who continued to invest would perform better than those who didn't. This irrational behavior can be seen in the younger people who choose to invest in safe things such as bonds and money market funds. By ignoring much higher return investments, they are acting irrationally, in a sense. Anyway, the paper details the entire research study.

I did not do a great job summarizing, so I urge you to read the paper. I found it interesting, as it can be related to investing in stocks as well as investing in poker skills. There are quite a few good players that are sufficiently bankrolled to play much higher stake games. In the long run, these players would be much better off playing them. However, there is often the sense of fear that holds them back. I personally believe that I could play a little bit higher, but I don't... precisely because of fear. This particular problem obviously does not afflict all of us... my friend, PetDander, would be a great example of someone who continues to move higher and higher up the poker food chain. Now, if only I could hit my head just right to produce the kind of brain damage that would allow me to be tilt-free.