So, I've been busy moving. I have moved away from Milpitas (a landfill) to Campbell (not a landfill).

The new place is pretty nice, not amazing by any means, but it's a good sized 1 bedroom apartment at around 825 square feet. I'll be putting up a few pictures once the place is cleaned up a bit. It's a total mess right now. Unfortunately, I got cable and internet hooked up today. So, I've lost all motivation to clean up the place, but I'll see what I can do.

One of the fun parts of moving is that you get to try new places to eat. So, last night I tried this little joint called Taco Bravo. It wasn't all that great, but the food was damn cheap and better than Taco Bell. But, the best part is that they're open until 3am each day. And, then there's Camille's nearby, which offers a BOGO special every Tuesday and Saturday.

That's all for now.

Main Page: bruteforcex.blogspot.com

Random posts about anything I've found interesting.

Contact Me: BruteForceXYZ (at) hotmail (dot) com

Tuesday, February 28, 2006

Thursday, February 23, 2006

A Kodak Moment

Well, Eastman Kodak (EK) has really been moving lately. Some of you may have heard that Bill Miller of Legg Mason finished the year 2005 with 71.5 million shares of EK, a 25% stake. I'm in good company; Miller is a stock-picking genius having beaten the S&P 500 for some fifteen years straight.

I've been waiting for EK, and a couple of times I was tempted to exit the position, but I am a believer.

Here's a 10-day chart of EK from BigCharts. The move is accompanied by serious volume pickup, which is nice to see.

PS: Those XM Satellite Radio (XMSR) calls have moved up nicely with XMSR trading at 22.50. But, I'm not quite ready to take profits, so I'll let it ride for better or worse.

I've been waiting for EK, and a couple of times I was tempted to exit the position, but I am a believer.

Here's a 10-day chart of EK from BigCharts. The move is accompanied by serious volume pickup, which is nice to see.

PS: Those XM Satellite Radio (XMSR) calls have moved up nicely with XMSR trading at 22.50. But, I'm not quite ready to take profits, so I'll let it ride for better or worse.

Monday, February 20, 2006

My First Meme

I don't even know what a "meme" really is or how that term came about... anyway, after some prodding by Miss Mt. Fuji, here's my meme:

1. First Name? Brute.

2. Were you named after anyone? After an inefficient algorithm technique.

3. Do you wish on stars? Only on PokerStars.

4. When did you last cry? Maybe a year or so ago.

5. Do you like your handwriting? No, it's pretty bad.

6. What is your favorite lunchmeat? Salami.

7. What is your birth date? Why don't I tell you all the last 4 digits of my social too.

8. Mountains or Beach? Beach.

9. If you were another person, would you be friends with you? Yes, it'd be pretty awesome.

10. Do you have a journal? This blog is the extent of it.

11. Do you use sarcasm a lot? Not really.

12. Do you have a nickname? Yes, but they're personal.

13. Would you bungee jump? Probably not.

14. Do you untie your shoes when you take them off? Rarely.

15. Do you think that you are strong? No.

16. What is your favorite ice-cream flavor? Rocky Road.

17. Shoe size? 10.5 - 11. Depends (on what the girl wants to hear).

18. Red or pink? Red.

19. What is your least favorite thing about yourself? I am out of shape.

20. Who or what do you miss most? I miss the years when I was 22 to 25.

21. Do you want everyone you send this to, to send it back? No.

22. What color pants and shoes are you wearing right now? PJ pants, no shoes.

23. What are you listening to right now? Nothing.

24. Last thing you ate? Chicken and Mushroom Fettucine

25. If you were a crayon, what color would you be? Silver.

26. What is the weather like right now? Chilly.

27. Last person you talked to on the Phone? Gary the Intern.

28. 1st thing you notice about the opposite sex? Body / Weight.

29. Do you like the person who sent this to you? Sure, she's cool.

30. Favorite drink? Alcoholic: Scotch. Non-Alcoholic: Ice Tea.

31. What is your favorite sport? I enjoy watching baseball, but I'm not a huge fan of any one sport, really.

32. Hair color? Black.

33. Eye color? Brown.

34. Do you wear contacts? No.

35. Favorite Food? Sushi.

36. Last movie you watched? When A Stranger Calls.

37. Favorite day of the Year? New Year's Eve.

38. Scary Movies or Happy Endings? Happy Endings.

39. Summer or Winter? Summer.

40. Hugs or Kisses? Kisses.

41. What is your favorite dessert? Mousse.

42. Living arrangements? 1 BR Apartment in 2 days.

43. What books are you reading? Life of Pi and Maxwell's Demon: Entropy, Information and Computing.

44. What did you watch last night on TV? Winter Olympics.

45. Favorite sounds? One hand clapping.

46. What's the furthest you've been from home? China.

And there you have it. My first meme.

1. First Name? Brute.

2. Were you named after anyone? After an inefficient algorithm technique.

3. Do you wish on stars? Only on PokerStars.

4. When did you last cry? Maybe a year or so ago.

5. Do you like your handwriting? No, it's pretty bad.

6. What is your favorite lunchmeat? Salami.

7. What is your birth date? Why don't I tell you all the last 4 digits of my social too.

8. Mountains or Beach? Beach.

9. If you were another person, would you be friends with you? Yes, it'd be pretty awesome.

10. Do you have a journal? This blog is the extent of it.

11. Do you use sarcasm a lot? Not really.

12. Do you have a nickname? Yes, but they're personal.

13. Would you bungee jump? Probably not.

14. Do you untie your shoes when you take them off? Rarely.

15. Do you think that you are strong? No.

16. What is your favorite ice-cream flavor? Rocky Road.

17. Shoe size? 10.5 - 11. Depends (on what the girl wants to hear).

18. Red or pink? Red.

19. What is your least favorite thing about yourself? I am out of shape.

20. Who or what do you miss most? I miss the years when I was 22 to 25.

21. Do you want everyone you send this to, to send it back? No.

22. What color pants and shoes are you wearing right now? PJ pants, no shoes.

23. What are you listening to right now? Nothing.

24. Last thing you ate? Chicken and Mushroom Fettucine

25. If you were a crayon, what color would you be? Silver.

26. What is the weather like right now? Chilly.

27. Last person you talked to on the Phone? Gary the Intern.

28. 1st thing you notice about the opposite sex? Body / Weight.

29. Do you like the person who sent this to you? Sure, she's cool.

30. Favorite drink? Alcoholic: Scotch. Non-Alcoholic: Ice Tea.

31. What is your favorite sport? I enjoy watching baseball, but I'm not a huge fan of any one sport, really.

32. Hair color? Black.

33. Eye color? Brown.

34. Do you wear contacts? No.

35. Favorite Food? Sushi.

36. Last movie you watched? When A Stranger Calls.

37. Favorite day of the Year? New Year's Eve.

38. Scary Movies or Happy Endings? Happy Endings.

39. Summer or Winter? Summer.

40. Hugs or Kisses? Kisses.

41. What is your favorite dessert? Mousse.

42. Living arrangements? 1 BR Apartment in 2 days.

43. What books are you reading? Life of Pi and Maxwell's Demon: Entropy, Information and Computing.

44. What did you watch last night on TV? Winter Olympics.

45. Favorite sounds? One hand clapping.

46. What's the furthest you've been from home? China.

And there you have it. My first meme.

Sunday, February 19, 2006

The Hike and the Mutant Cheeto

Today, we went on a hike over at Mission Peak in Fremont with our buddy D-Pac (of the Shakur tribe). He used to do the hike every week, but he's apparently stopped and hasn't done it in a while. I've never done it, and I was pretty impressed with how tough it was given that it was less than 3 miles up. Then again, I'm really not a hiker, and I'm also an out of shape software guy. Ha ha.

After the hike, the three of us treated ourselves to some Elephant Bar food. D-Pac and I must have had 4 glasses of lemonade each, and QB had a Mojito that wasn't quite as good as those she had at the Cuban-themed ERR party.

Before I forget, here's a picture of the mutant Cheeto. I put it next to a normal one to really put it into perspective. For those of you that don't eat Flamin' Hot Cheetos... the small red one is the mutant. All normal Cheetos more or less look like the bigger one.

After the hike, the three of us treated ourselves to some Elephant Bar food. D-Pac and I must have had 4 glasses of lemonade each, and QB had a Mojito that wasn't quite as good as those she had at the Cuban-themed ERR party.

Before I forget, here's a picture of the mutant Cheeto. I put it next to a normal one to really put it into perspective. For those of you that don't eat Flamin' Hot Cheetos... the small red one is the mutant. All normal Cheetos more or less look like the bigger one.

Friday, February 17, 2006

Quick Trade Update

Taking a shot here on XM Satellite Radio (XMSR) via March 20 Call options (QSYCD). Picked up some contracts at 2.40. Their earnings weren't as strong as investors had hoped, and Sirius Satellite (SIRI) also disappointed. That said, I believe that the rather drastic drop in its share price is a bit overdone.

Wednesday, February 15, 2006

Valentine's 2006

There are many people out there who really hate Valentine's and all of the commercialization surrounding it. I personally don't mind the commercialization. It is because of it that you'll have some restaurants preparing special menus for you and your date. I've always done the Valentine's thing, and I've always enjoyed it. To me, it's not all that different from celebrating a birthday, but instead of honoring one person, it's really paying tribute to the bond of two people.

Anyway, that's my Sicilian Defense of Valentine's Day. I don't think it's Sicilian in origin though. Ha ha.

So, yesterday I did the whole flowers to work thing, which isn't usually my thing. Just like in poker, you have got to mix it up some times. Then, it was dinner at Birk's. I had never been there, but I had heard that the food was fantastic. We arrived a full fifteen minutes before our reservation, and so there was a short wait.

After being seated, we were given a bread basket with three different types of bread. I'm not much of a bread guy, but I can assure you that the bread was quite good. The service started off a bit slow, but it did get a lot better as the night progressed.

We started off with an order of the Seared Ahi, which was served with a really tasty calamari seaweed salad. We also went with the Jumbo Shrimp Cocktail, which was okay, but nothing extraordinary. For the main course, I had the Prime Rib, and she went for the Peppered Filet Mignon. The cut of meat was huge. I was not able to finish off the sides that came with my meat, and I also had to help her out a bit. We didn't have any room for dessert.

Now, for my super quick review. The food was very good, but it certainly wasn't anywhere near the best steak I've had... that would be Brook's in Denver (thanks to the GZA of 12th Street and "in-lieu of travel"). The service was good once we got over the initial hump. I might go back one day, but if I didn't, I wouldn't really feel that I was missing anything spectacular.

One last thing... I got a really nice Valentine's gift. It was a personalized wall calendar with a different photo of us for each month. The photos were ordered such that as you go from January to December, you'd be travelling back in time and catch a glimpse of the various places we'd been. I really liked it, and I appreciate the thought that went into it.

Ok, that's all for now. And, to all you V-Day haters, you've got a whole year before you hate again.

Anyway, that's my Sicilian Defense of Valentine's Day. I don't think it's Sicilian in origin though. Ha ha.

So, yesterday I did the whole flowers to work thing, which isn't usually my thing. Just like in poker, you have got to mix it up some times. Then, it was dinner at Birk's. I had never been there, but I had heard that the food was fantastic. We arrived a full fifteen minutes before our reservation, and so there was a short wait.

After being seated, we were given a bread basket with three different types of bread. I'm not much of a bread guy, but I can assure you that the bread was quite good. The service started off a bit slow, but it did get a lot better as the night progressed.

We started off with an order of the Seared Ahi, which was served with a really tasty calamari seaweed salad. We also went with the Jumbo Shrimp Cocktail, which was okay, but nothing extraordinary. For the main course, I had the Prime Rib, and she went for the Peppered Filet Mignon. The cut of meat was huge. I was not able to finish off the sides that came with my meat, and I also had to help her out a bit. We didn't have any room for dessert.

Now, for my super quick review. The food was very good, but it certainly wasn't anywhere near the best steak I've had... that would be Brook's in Denver (thanks to the GZA of 12th Street and "in-lieu of travel"). The service was good once we got over the initial hump. I might go back one day, but if I didn't, I wouldn't really feel that I was missing anything spectacular.

One last thing... I got a really nice Valentine's gift. It was a personalized wall calendar with a different photo of us for each month. The photos were ordered such that as you go from January to December, you'd be travelling back in time and catch a glimpse of the various places we'd been. I really liked it, and I appreciate the thought that went into it.

Ok, that's all for now. And, to all you V-Day haters, you've got a whole year before you hate again.

Thursday, February 09, 2006

Paring An Apple

Well, I've been stuck in an all-day meeting, but I just wanted to pop in here to say that I have now trimmed my Apple (AAPL) position. My position is now half the original size. So, a partial loss has been realized. My exit point via a stop is in the 66.30's.

Will hold the other half... for now.

Brutal day for the Trading Portfolio, but a nice day for the Long-Term Portfolio.

That's all for now, I better get back to the meeting.

Will hold the other half... for now.

Brutal day for the Trading Portfolio, but a nice day for the Long-Term Portfolio.

That's all for now, I better get back to the meeting.

Quick Update

Established a position in Allegheny Technologies (ATI) for the Trading Portfolio at 50.00. I know that blog reader and once-in-a-while commenter, JT, has been pretty damn bullish on precious metals, and we've talked about them a bit in the past. Recently, a nother buddy of mine mentioned ATI as a potential play, and I took a hard look at it yesterday.

Metals prices have been on a tear, and ATI certainly benefits from this trend. They produce a wide array of specialty materials ranging from Titanium alloys all the way to sheets of Stainless Steel.

Let's see how this trade goes... I'm willing to hold this for a little while to see how it plays out, but I'm putting a stop in place on this one in case it tanks.

Form Factor (FORM) is making another move today... I know I caught it a bit late, but better late than never.

Metals prices have been on a tear, and ATI certainly benefits from this trend. They produce a wide array of specialty materials ranging from Titanium alloys all the way to sheets of Stainless Steel.

Let's see how this trade goes... I'm willing to hold this for a little while to see how it plays out, but I'm putting a stop in place on this one in case it tanks.

Form Factor (FORM) is making another move today... I know I caught it a bit late, but better late than never.

Wednesday, February 08, 2006

Yeti Olympics and Apple Grinding

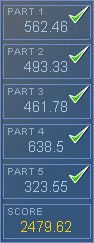

So, I got a new high score on Yeti Olympics. It's probably not all that great, but it's my personal best so far. It does look like I need a ton more practice in the Flamingo Drive event. That score of 323 is pitiful.

This morning, I was able to trade additional Apple (AAPL) shares today (entries at 66.60 and 66.75 with exits at 67.48 and 67.53, respectively) shaving about 1.29 from my effective cost... current effective cost basis is now 72.03. Still underwater quite a bit, but I'm going to wait and see. As I might have mentioned before, if it does drop significantly from here, I will be looking to trim part of the position.

*** Edit #1: Shaved off another 18 cents... with an entry/exit at 68.18/68.43. Updated effective cost basis: 71.85.

This morning, I was able to trade additional Apple (AAPL) shares today (entries at 66.60 and 66.75 with exits at 67.48 and 67.53, respectively) shaving about 1.29 from my effective cost... current effective cost basis is now 72.03. Still underwater quite a bit, but I'm going to wait and see. As I might have mentioned before, if it does drop significantly from here, I will be looking to trim part of the position.

*** Edit #1: Shaved off another 18 cents... with an entry/exit at 68.18/68.43. Updated effective cost basis: 71.85.

Tuesday, February 07, 2006

Old School Web Games

Most of you probably have played that Fly The Copter game. If you liked it, then you might also be entertained by this other old school game, Ball A'track. Also, the Yeti Olympics game is a ton of fun too... I really had forgotten just how much fun this one was. Anyway, I just wasted some of my time playing these.

Here are my best scores for the Fly The Copter and Ball A'track games:

Here are my best scores for the Fly The Copter and Ball A'track games:

Monday, February 06, 2006

A Pisser of a Day

I'm going to vent just a tad here...

What a piss poor day for me with respect to the market. First, Apple (AAPL) gets absolutely clobbered. If this continues, I'm going to be taking a partial loss by dumping half my position. What else?

Remember how I've been thinking about investing in Texas Roadhouse (TXRH)? Well, I have still been researching it, and preparing to buy it... well, Cramer (Mr. Mad Money) pumped it today saying the following (paraphrased):

Texas Roadhouse is the next great regional-to-national food chain. The company runs almost 200 roadhouse-themed restaurants in almost 34 states, and country singer Willie Nelson has been the restaurant chain's spokesman since 2003. If it is like other great regional-to-national stories, it could go from 200 to 800 restaurants, or even more, if the concept is good and management is sound.

The stock ran up today to the 16's. Well, tomorrow is another day... with Fortune Brands (FO) reporting earnings before the open. Let's see how the cruel market treats me tomorrow. Woe is me! Woe is me!

So, yes... it's really not a good day for me. And, yes, I'm quite frustrated by the recent action.

What a piss poor day for me with respect to the market. First, Apple (AAPL) gets absolutely clobbered. If this continues, I'm going to be taking a partial loss by dumping half my position. What else?

Remember how I've been thinking about investing in Texas Roadhouse (TXRH)? Well, I have still been researching it, and preparing to buy it... well, Cramer (Mr. Mad Money) pumped it today saying the following (paraphrased):

Texas Roadhouse is the next great regional-to-national food chain. The company runs almost 200 roadhouse-themed restaurants in almost 34 states, and country singer Willie Nelson has been the restaurant chain's spokesman since 2003. If it is like other great regional-to-national stories, it could go from 200 to 800 restaurants, or even more, if the concept is good and management is sound.

The stock ran up today to the 16's. Well, tomorrow is another day... with Fortune Brands (FO) reporting earnings before the open. Let's see how the cruel market treats me tomorrow. Woe is me! Woe is me!

So, yes... it's really not a good day for me. And, yes, I'm quite frustrated by the recent action.

The Weekend

The weekend was pretty much front-end loaded.

So, on Friday night, I went to shoot some pool and play some poker (for no money, even!) at home with a few friends.

On Saturday afternoon, we attended a Chnese New Year's party thrown by a co-worker of mine. Even though I was a bit tired from the night before, it was definitely fun, and I had a good time. There was a lot of karaoke-ing going on, but I didn't take any part in that. Frankly, I don't want to get sued for ruining anyone's hearing. Then, there was some serious Pictionary gaming... girls against guys. Guys won, of course. The first card I draw was udder, which wasn't too bad. My cow looked more like a horse, but my team figured it out. I'm no Picasso, but I did okay.

There was a birthday party Saturday night for Lady E. Started off at her apartment, then we headed out to The Saddle Rack over in Fremont.. Yee Haw! I had heard about the place before, but I had never been. The place was huge, and inside there was a mechanical bull. Pretty nuts. There were more than a few real cowboys there... I mean it was totally entertaining watching a few of them last as long as they did on this ridiculous bull machine. If you like country music at all, it's definitely the place to be. Quite a few people were dressed Western style, and the cowgirls looked a hell of a lot better than the average Silicon Valley partygoer. While the cover was steep, the place did have a few $2 beer specials. I've never really seen such a deal at any place on a Saturday night. In short, I had a lot of fun, but we left a bit early, because I was detecting early signs of a cold.

After a good night's sleep, I avoided any cold that I might have caught had I not allowed my body to rest. Anyway, I spent the day making a list of apartments to check out. Should find a new place within the next 7 to 10 days, and should be ready to move out within 2 weeks. I missed most of the Superbowl, and I only caught a handful of commercials. I wasn't too big on either of the teams, so it's no biggie. I guess that's all.

So, on Friday night, I went to shoot some pool and play some poker (for no money, even!) at home with a few friends.

On Saturday afternoon, we attended a Chnese New Year's party thrown by a co-worker of mine. Even though I was a bit tired from the night before, it was definitely fun, and I had a good time. There was a lot of karaoke-ing going on, but I didn't take any part in that. Frankly, I don't want to get sued for ruining anyone's hearing. Then, there was some serious Pictionary gaming... girls against guys. Guys won, of course. The first card I draw was udder, which wasn't too bad. My cow looked more like a horse, but my team figured it out. I'm no Picasso, but I did okay.

There was a birthday party Saturday night for Lady E. Started off at her apartment, then we headed out to The Saddle Rack over in Fremont.. Yee Haw! I had heard about the place before, but I had never been. The place was huge, and inside there was a mechanical bull. Pretty nuts. There were more than a few real cowboys there... I mean it was totally entertaining watching a few of them last as long as they did on this ridiculous bull machine. If you like country music at all, it's definitely the place to be. Quite a few people were dressed Western style, and the cowgirls looked a hell of a lot better than the average Silicon Valley partygoer. While the cover was steep, the place did have a few $2 beer specials. I've never really seen such a deal at any place on a Saturday night. In short, I had a lot of fun, but we left a bit early, because I was detecting early signs of a cold.

After a good night's sleep, I avoided any cold that I might have caught had I not allowed my body to rest. Anyway, I spent the day making a list of apartments to check out. Should find a new place within the next 7 to 10 days, and should be ready to move out within 2 weeks. I missed most of the Superbowl, and I only caught a handful of commercials. I wasn't too big on either of the teams, so it's no biggie. I guess that's all.

Friday, February 03, 2006

Another Quick Update

Took a bite of Form Factor (FORM). The company announced a stellar quarter couple days ago, and the stock moved huge to the upside yesterday. Picked up a piece at 36.20.

I've been following the company for some time, and I never did get around to buy it when it was still low. Maybe I'm chasing a bit here, but I do believe the company is pretty strong. A buddy of mine works there, and he's always very bullish on the company and its technology. Their chip testing technology has no peers from what I have heard, and they are currently actively hiring and looking to expand their operations. Anyway, I first announced that I had put the company on the radar long ago in this post. Too bad I hadn't taken a position earlier...

Also, Apple (AAPL) continues to be a slight pain in the rear.

*** Edit #1: Closed out my "gambling" positions for losses. Closed out the AAPL bull call spread at 0.25 for a net loss of 0.95. Also, dumped the Google (GOOG) call option at $1.65 for a nice 95% loss. Might as well get something for it while I can.

I've been following the company for some time, and I never did get around to buy it when it was still low. Maybe I'm chasing a bit here, but I do believe the company is pretty strong. A buddy of mine works there, and he's always very bullish on the company and its technology. Their chip testing technology has no peers from what I have heard, and they are currently actively hiring and looking to expand their operations. Anyway, I first announced that I had put the company on the radar long ago in this post. Too bad I hadn't taken a position earlier...

Also, Apple (AAPL) continues to be a slight pain in the rear.

*** Edit #1: Closed out my "gambling" positions for losses. Closed out the AAPL bull call spread at 0.25 for a net loss of 0.95. Also, dumped the Google (GOOG) call option at $1.65 for a nice 95% loss. Might as well get something for it while I can.

Thursday, February 02, 2006

Quick Update and News

EBAY - Sold the entire position today at 42 flat. That was a position from long ago with an effective basis of 37.11.

Fortune Brands (FO) - Ran up a little today, probably due to an upgrade by FTN Midwest Research to Buy. The firm's FO analyst, Eric Brosshard, has been bullish on the company for a while... so, now that I think about it, it is probably a reiteration of a Buy rating.

Apple (AAPL) - Under fairly heavy selling pressure today. The most likely reason for this drop is a research note by Shaw Wu of American Technology Research. In his note, he writes about how he “overestimated the uptake of Windows Media in digital music," and also how he believes that the "Windows Media and its PlaysForSure DRM could emerge as a legitimate number two player.” Been playing around a bit with AAPL, but continue to hold the original position, which now has an effective cost basis of 73.32.

American Eagle Outfitters (AEOS) - The stock's been doing well recently. Yesterday's same store sales figures showed a solid jump of 11.4% handily exceeding consensus estimates of 7.4%. The street expected more, I suppose, as the shares are trading down roughly 4% this morning.

Fortune Brands (FO) - Ran up a little today, probably due to an upgrade by FTN Midwest Research to Buy. The firm's FO analyst, Eric Brosshard, has been bullish on the company for a while... so, now that I think about it, it is probably a reiteration of a Buy rating.

Apple (AAPL) - Under fairly heavy selling pressure today. The most likely reason for this drop is a research note by Shaw Wu of American Technology Research. In his note, he writes about how he “overestimated the uptake of Windows Media in digital music," and also how he believes that the "Windows Media and its PlaysForSure DRM could emerge as a legitimate number two player.” Been playing around a bit with AAPL, but continue to hold the original position, which now has an effective cost basis of 73.32.

American Eagle Outfitters (AEOS) - The stock's been doing well recently. Yesterday's same store sales figures showed a solid jump of 11.4% handily exceeding consensus estimates of 7.4%. The street expected more, I suppose, as the shares are trading down roughly 4% this morning.

Wednesday, February 01, 2006

Tuesday, January 31, 2006

More Apple Picking and More

In an effort to reduce my effective basis on Apple (AAPL), I picked up a couple more pieces of AAPL at 74.17 and 73.94. Will unwind these extra positions as we move higher, or the positions will get stopped out at 73.50.

*** Edit #1: Exited one piece just now at 75.24.

*** Edit #2: The other piece was just sold at 75.67. So, we are back to our original position at a much lower cost basis. Will calculate and update in a future post.

*** Edit #3: Spud jumped in to play some Google (GOOG) in anticipation of its earnings to be released shortly after market close... In a show of support, I decided to throw out a small gamble and picked up a single Feb 430 call contract at 28.40. If GOOG moves up, great. If not, them's the breaks.

*** Edit #1: Exited one piece just now at 75.24.

*** Edit #2: The other piece was just sold at 75.67. So, we are back to our original position at a much lower cost basis. Will calculate and update in a future post.

*** Edit #3: Spud jumped in to play some Google (GOOG) in anticipation of its earnings to be released shortly after market close... In a show of support, I decided to throw out a small gamble and picked up a single Feb 430 call contract at 28.40. If GOOG moves up, great. If not, them's the breaks.

Monday, January 30, 2006

Quick Updates

Juniper Networks (JNPR) sold for a loss in the mid-17's last Friday. Today, picked up a fresh new block of Apple (AAPL) at 72.25 this morning. The stock finally caught a bid, and I exited at 74.50. This decreases the cost basis on the remaining Apple position to 74.52. This does not include the $1.20 I threw at the bull spread.

Eastman Kodak (EK) posted earnings today. I didn't think the report was all that bad. Shares are down on the report, however.

And, the ERR party was absolutely off the hook. Some pictures will be coming soon (I hope).

Eastman Kodak (EK) posted earnings today. I didn't think the report was all that bad. Shares are down on the report, however.

And, the ERR party was absolutely off the hook. Some pictures will be coming soon (I hope).

Friday, January 27, 2006

The Next Few Days

First thing's first... there's a worm in my Apple (AAPL). My entry in the 77's isn't looking so hot right now. But, I was able to shave off about 70 cents from my cost basis, so we're looking at 76.50 or so. I was able to shave some off by selling shares and then buying them back cheaper with the full intention of buying them back even if it meant I had to buy it back a little bit higher. Fortunately, that didn't happen. Also, you have no idea how relieved I am to have taken the Broadcom (BRCM) loss at 57. Today, the company announced one of the most spectacular quarters, and the stock finished trading afterhours over $70. Naz futures are up nicely at this hour, and the Nikkei posted a rather sick gain of nearly 570 points (or nearly 3.6%). Finally, Juniper Networks (JNPR) was a thorn in my portfolio today... I'll be looking to take a loss in that position soon and be done with it.

Ok, enough stock talk.

Tomorrow, my good friend, Spud, flies in to town from SoCal. He'll be here for the weekend to attend the Last ERR Party Ever, aptly named Apocalypse Ranch (entire list of video invitations here). This party has gotten a ton of hype, and I am quite confident that it will live up to it, and then some.

Here's a snippet from an e-mail I received from one of the original ERR guys:

TONS of people are flying in for the party. It certainly has all the opportunity to be our greatest party to date.

When people are willing to fly cross-country for a single party, you gotta believe it's going to rock.

On Saturday, another SoCal partygoer will be arriving... Ms. Mt. Fuji. Here's the current parlay... She promises to get really trashed and not jump all over any of my friends when in a drunken state. I'll lay 2 to 1 odds against. Just kidding... I'm sure she'll behave, but she is a ton of fun and the ERR is going to be a better place with her there.

I'm really quite pumped up about this weekend. It is really going to be supercharged. I also feel a bit sad that the ridiculous string of the most ridiculously good parties is all coming to a most ridiculous end.

Ok, enough stock talk.

Tomorrow, my good friend, Spud, flies in to town from SoCal. He'll be here for the weekend to attend the Last ERR Party Ever, aptly named Apocalypse Ranch (entire list of video invitations here). This party has gotten a ton of hype, and I am quite confident that it will live up to it, and then some.

Here's a snippet from an e-mail I received from one of the original ERR guys:

TONS of people are flying in for the party. It certainly has all the opportunity to be our greatest party to date.

When people are willing to fly cross-country for a single party, you gotta believe it's going to rock.

On Saturday, another SoCal partygoer will be arriving... Ms. Mt. Fuji. Here's the current parlay... She promises to get really trashed and not jump all over any of my friends when in a drunken state. I'll lay 2 to 1 odds against. Just kidding... I'm sure she'll behave, but she is a ton of fun and the ERR is going to be a better place with her there.

I'm really quite pumped up about this weekend. It is really going to be supercharged. I also feel a bit sad that the ridiculous string of the most ridiculously good parties is all coming to a most ridiculous end.

Tuesday, January 24, 2006

Trade Update

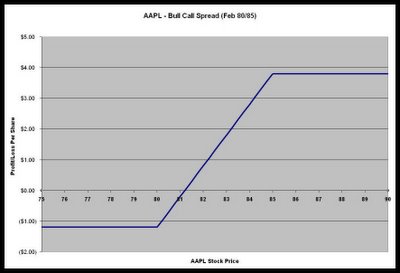

Boosting my exposure to Apple (AAPL) via a Bull Call Spread established today for a debit of $1.20 per contract. For those unfamiliar with this option spread, it is the purchase of call options at some strike price and the sale of call options on the same security at a higher strike price.

In this particular trade, I went long the Feb 80's for $2.20 and short the Feb 85's for $1.00.

The spread expires on February 17. So, I basically need AAPL to move into the profitable range by then. The spread limits both upside and downside. Ignoring transaction costs, break-even for this spread is at AAPL equal to $81.20. Here's a profit-loss diagram for the spread I entered into today. (Click Image to Enlarge)

In this particular trade, I went long the Feb 80's for $2.20 and short the Feb 85's for $1.00.

The spread expires on February 17. So, I basically need AAPL to move into the profitable range by then. The spread limits both upside and downside. Ignoring transaction costs, break-even for this spread is at AAPL equal to $81.20. Here's a profit-loss diagram for the spread I entered into today. (Click Image to Enlarge)

Monday, January 23, 2006

Gotta Talk About Gotta

This might be really obvious to some of you, but it struck me recently that not everyone knows what words gotta replaces.

There are some who believe that gotta replaces "got to." But, the truth is that gotta stands for "have got to."

"I gotta go to the movies." IS EQUIVALENT TO "I have got to go to the movies." AND NOT EQUIVALENT TO "I got to go to the movies," which means something completely different.

"Got To" means "was able to," whereas "Have/Has Got To" holds a meaning much closer to "must."

A pretty mundane observation, really... but it was a real source of confusion the other day when I was chatting with a friend online. Just wanted to straighten everyone out.

There are some who believe that gotta replaces "got to." But, the truth is that gotta stands for "have got to."

"I gotta go to the movies." IS EQUIVALENT TO "I have got to go to the movies." AND NOT EQUIVALENT TO "I got to go to the movies," which means something completely different.

"Got To" means "was able to," whereas "Have/Has Got To" holds a meaning much closer to "must."

A pretty mundane observation, really... but it was a real source of confusion the other day when I was chatting with a friend online. Just wanted to straighten everyone out.

Subscribe to:

Comments (Atom)